Question: A 1 A * A A - E EES AaBbCcDc AaBbceDe AaBbc AaBbcc AaB Aabbcc Normal No Spac. Heading 1 Heading 2 Title Subtitle Replace

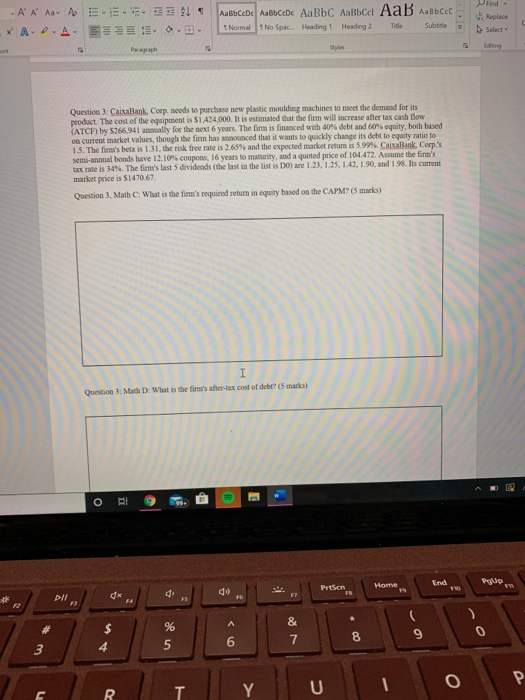

A 1 A * A A - E EES AaBbCcDc AaBbceDe AaBbc AaBbcc AaB Aabbcc Normal No Spac. Heading 1 Heading 2 Title Subtitle Replace P A - s Question 3: CaixaBank, Corp needs to purchase new plastic moulding machines to meet the demand for its product. The cost of the equipment is $1.434,000. It is estimated that the firm will increase after tax cash flow (ATCF by $266,941 wally for the next 6 years. The firm is financed with 40% debt and 60% equity, both based 00 current market values, though the firm has announced that it wants to quickly change its debt to equity ratio to 1.5. The firm's beta is 1.31. the risk free rate is 2.65% and the expected market return is 5.999 CaixaBank, Corp's semi-annual bonds have 12.10% coupons, 16 years to maturity, and a quoted price of 104.472. Assume the firm's tax rate is 349. The firm's last 5 dividends (the last in the list is Do) are 1.23, 125, 142, 1.90 and 1.98. Its current market price is $1470 67. Question 3. Math C: What is the firm's required return in equity based on the CAPM? (5 marks) Math D the firm's after-tax cost of debt? (5 marks) pelo Presco Home

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts