Question: A ) # 1 B)#2 C) #3 D)#4 5) Which of the following statements is FALSE? A) If a bond trades at a premium, its

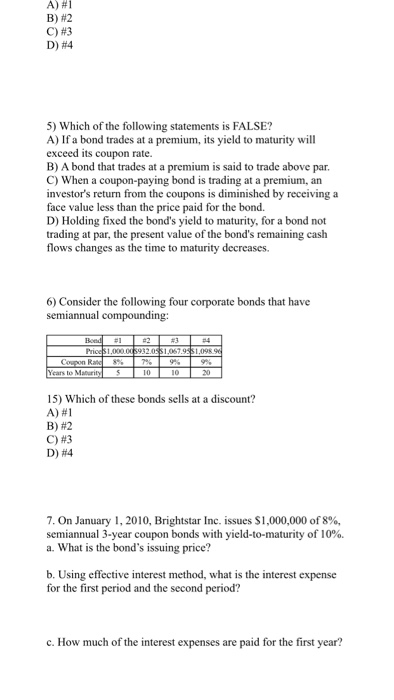

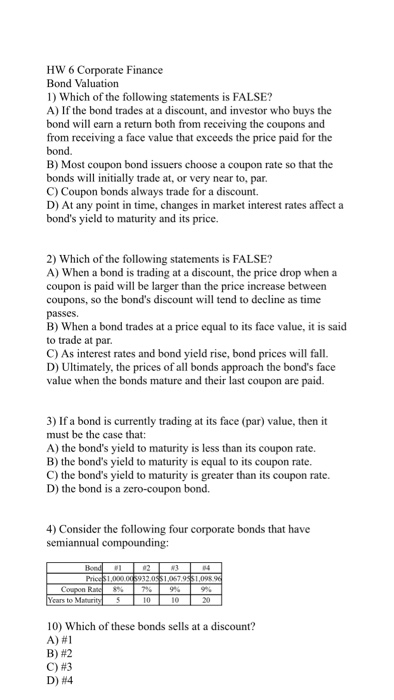

A ) # 1 B)#2 C) #3 D)#4 5) Which of the following statements is FALSE? A) If a bond trades at a premium, its yield to maturity will exceed its coupon rate. B) A bond that trades at a premium is said to trade above par. C) When a coupon-paying bond is trading at a premium, an investor's return from the coupons is diminished by receiving a face value less than D) Holding fixed the bond's yield to maturity, for a bond not trading at par, the present value of the bond's remaining cash flows changes as the time to maturity decreases. the price paid for the bond. 6) Consider the following four corporate bonds that have cars to Maturi 15) Which of these bonds sells at a discount? A) #1 ?) #2 C) #3 D)#4 7, on January 1, 2010, Brightstar Inc. issues $1,000,000 of 8%, semiannual 3-year coupon bonds with yield-to-maturity of 10%. a. What is the bond's issuing price? b. Using effective interest method, what is the interest expense for the first period and the second period? c. How much of the interest expenses are paid for the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts