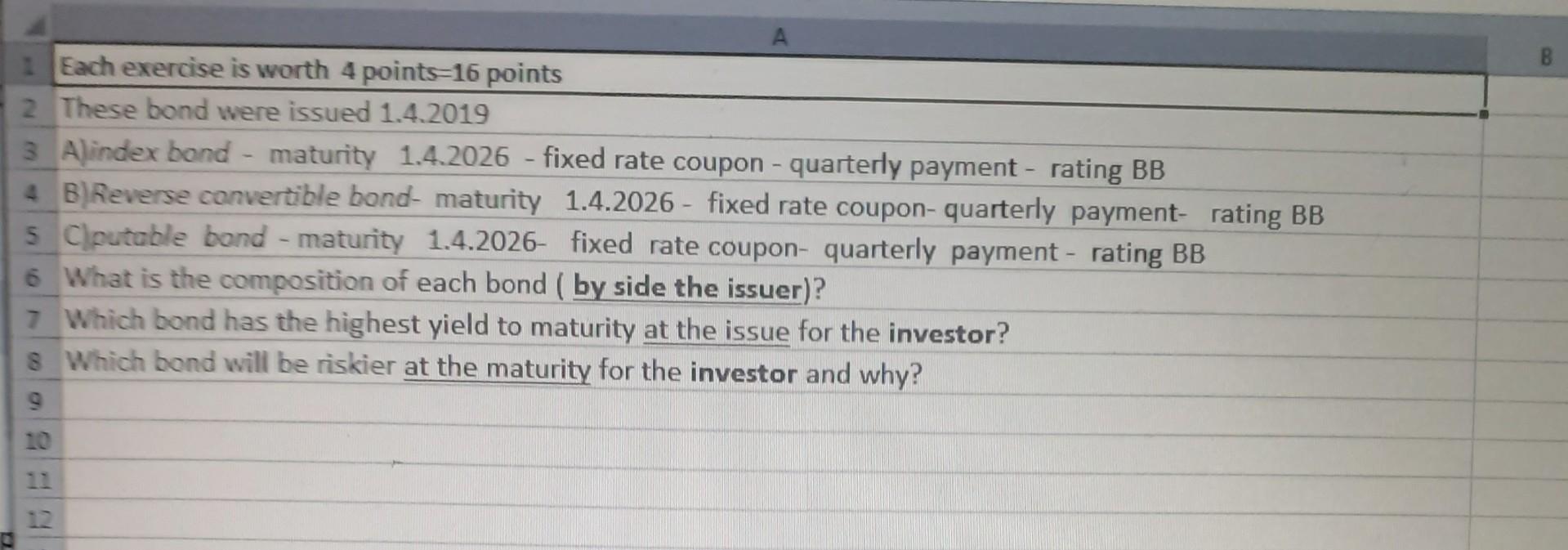

Question: A 1 Each exercise is worth 4 points=16 points 2 These bond were issued 1.4.2019 3 Alindex bond - maturity 1.4.2026 - fixed rate coupon

A 1 Each exercise is worth 4 points=16 points 2 These bond were issued 1.4.2019 3 Alindex bond - maturity 1.4.2026 - fixed rate coupon - quarterly payment - rating BB 4 B Reverse convertible bond- maturity 1.4.2026 - fixed rate coupon-quarterly payment- rating BB 5 Clputable bond - maturity 1.4.2026- fixed rate coupon- quarterly payment - rating BB 6 What is the composition of each bond ( by side the issuer)? 7 Which bond has the highest yield to maturity at the issue for the investor? 8 Which bond will be riskier at the maturity for the investor and why? 1 A 1 Each exercise is worth 4 points=16 points 2 These bond were issued 1.4.2019 3 Alindex bond - maturity 1.4.2026 - fixed rate coupon - quarterly payment - rating BB 4 B Reverse convertible bond- maturity 1.4.2026 - fixed rate coupon-quarterly payment- rating BB 5 Clputable bond - maturity 1.4.2026- fixed rate coupon- quarterly payment - rating BB 6 What is the composition of each bond ( by side the issuer)? 7 Which bond has the highest yield to maturity at the issue for the investor? 8 Which bond will be riskier at the maturity for the investor and why? 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts