Question: a. 1. Select the correct sentence for errors in the preceding report. 1. The maintenance salaries of $74,100 and indirect materials of $49,400 should be

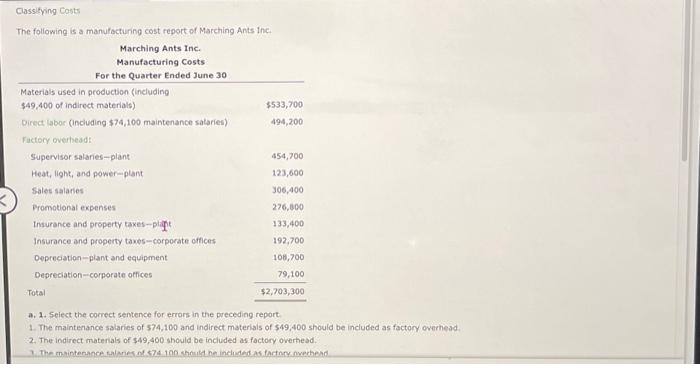

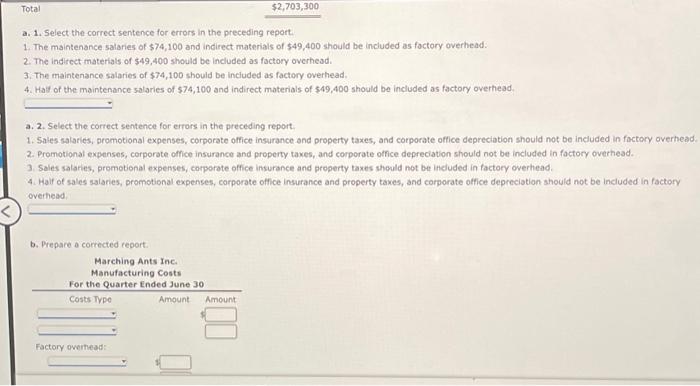

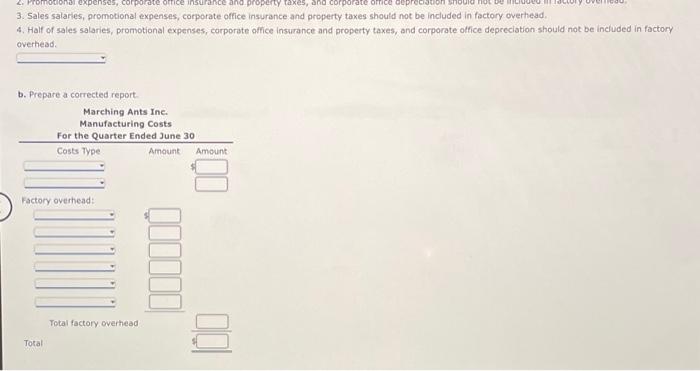

a. 1. Select the correct sentence for errors in the preceding report. 1. The maintenance salaries of $74,100 and indirect materials of $49,400 should be included as factory overhead. 2. The indirect materials of $49,400 should be included as factory overhead. 3. The maintenance salaries of $74,100 should be included as factory overhead. 4. Half of the maintenance salaries of $74,100 and indirect moterials of $49,400 should be included as factory overhead. a. 2. Select the correct sentence for errors in the preceding report. 1. Sales salaries, promotional expenses, corporate office insurance and property taxes, and corporate office depreciation should not be included in factory overhead. 2. Promotional expenses, corporate office insurance and property taxes, and corporate office depreciation should not be included in factory overhead. 3. Sales salaries, promotional expenses, corporote office insurance and property taxes should not be induded in factory overhead. 4. Haif of sales salaries, promotional expenses, corporate office insurance and property taxes, and corporate office depreciation should not be included in factory overhead: b. Prepare a corrected report. 3. Sales salaries, promotional expenses, corporate office insurance and property taxes should not be included in factory overhead. 4. Half of sales salaries, promotional expenses, corporate office insurance and property taxes, and corporate office depreciation-should not be included in factory overhead. b. Prepare a corrected report. Classifying Costs The following is a manufactuning cost report of Marching Ants the. a. 1. Select the correct sentence for errors in the preceding report 1. The maintenance salaries of $74,100 and indirect materials of $49,400 should be included as factory overhead. 2. The indirect materials of $49,400 should be included as factory overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts