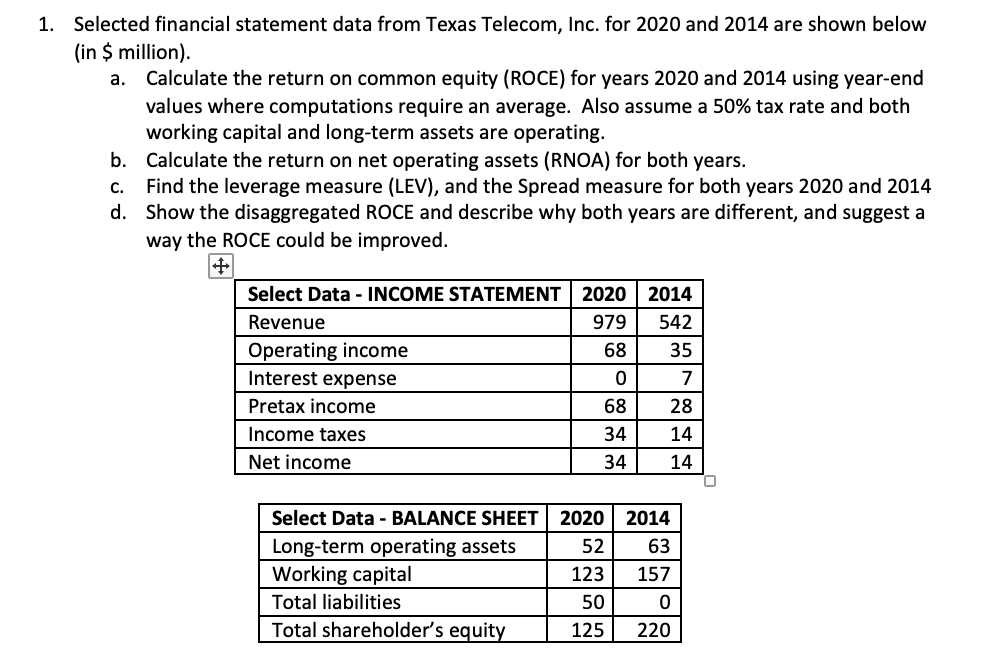

Question: a. 1. Selected financial statement data from Texas Telecom, Inc. for 2020 and 2014 are shown below (in $ million). Calculate the return on common

a. 1. Selected financial statement data from Texas Telecom, Inc. for 2020 and 2014 are shown below (in $ million). Calculate the return on common equity (ROCE) for years 2020 and 2014 using year-end values where computations require an average. Also assume a 50% tax rate and both working capital and long-term assets are operating. b. Calculate the return on net operating assets (RNOA) for both years. Find the leverage measure (LEV), and the Spread measure for both years 2020 and 2014 d. Show the disaggregated ROCE and describe why both years are different, and suggest a way the ROCE could be improved. C. + 2020 23 979 68 Select Data -INCOME STATEMENT Revenue Operating income Interest expense Pretax income Income taxes Net income 2014 542 35 7 0 68 34 28 14 14 O 34 2020 Select Data - BALANCE SHEET Long-term operating assets Working capital Total liabilities Total shareholder's equity 2014 63 157 52 123 50 125 0 220

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts