Question: (a) 11% (b) 77% (c) 60% (d) 22 13. Which of the following is least likely considered a source of systematic risk for bonds? (a)

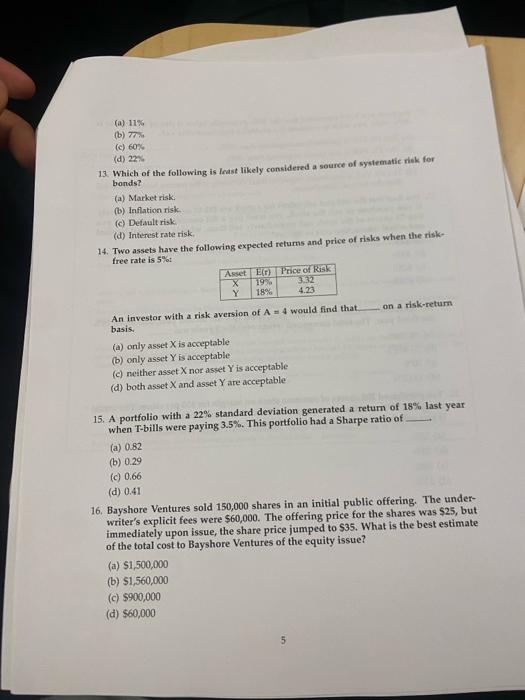

(a) 11% (b) 77% (c) 60% (d) 22 13. Which of the following is least likely considered a source of systematic risk for bonds? (a) Market risk. (b) Inflation risk. (c) Default risk (d) Interest rate risk. 14. Two assets have the following expected retums and price of risks when the riskfree rate is 5% : An investor with a risk aversion of A=4 would find that_on a risk-retum basis. (a) only asset X is acceptable (b) only asset Y is acceptable (c) neither asset X nor asset Y is acceptable (d) boch asset X and asset Y are acceptable 15. A portfolio with a 22% standard deviation generated a return of 18% last year when T-bills were paying 3.5%. This portfolio had a Sharpe ratio of (a) 0.82 (b) 0.29 (c) 0.66 (d) 0.41 16. Bayshore Ventures sold 150,000 shares in an initial public offering. The underwriter's explicit fees were $60,000. The offering price for the shares was $25, but immediately upon issue, the share price jumped to $35. What is the best estimate of the total cost to Bayshore Ventures of the equity issue? (a) $1,500,000 (b) $1,560,000 (c) $900,000 (d) $60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts