Question: A 13. Describe the difference between the direct write off method and the allowance for doubtful accounts method. Multiple Choice-18085 0615 14. The inventory valuation

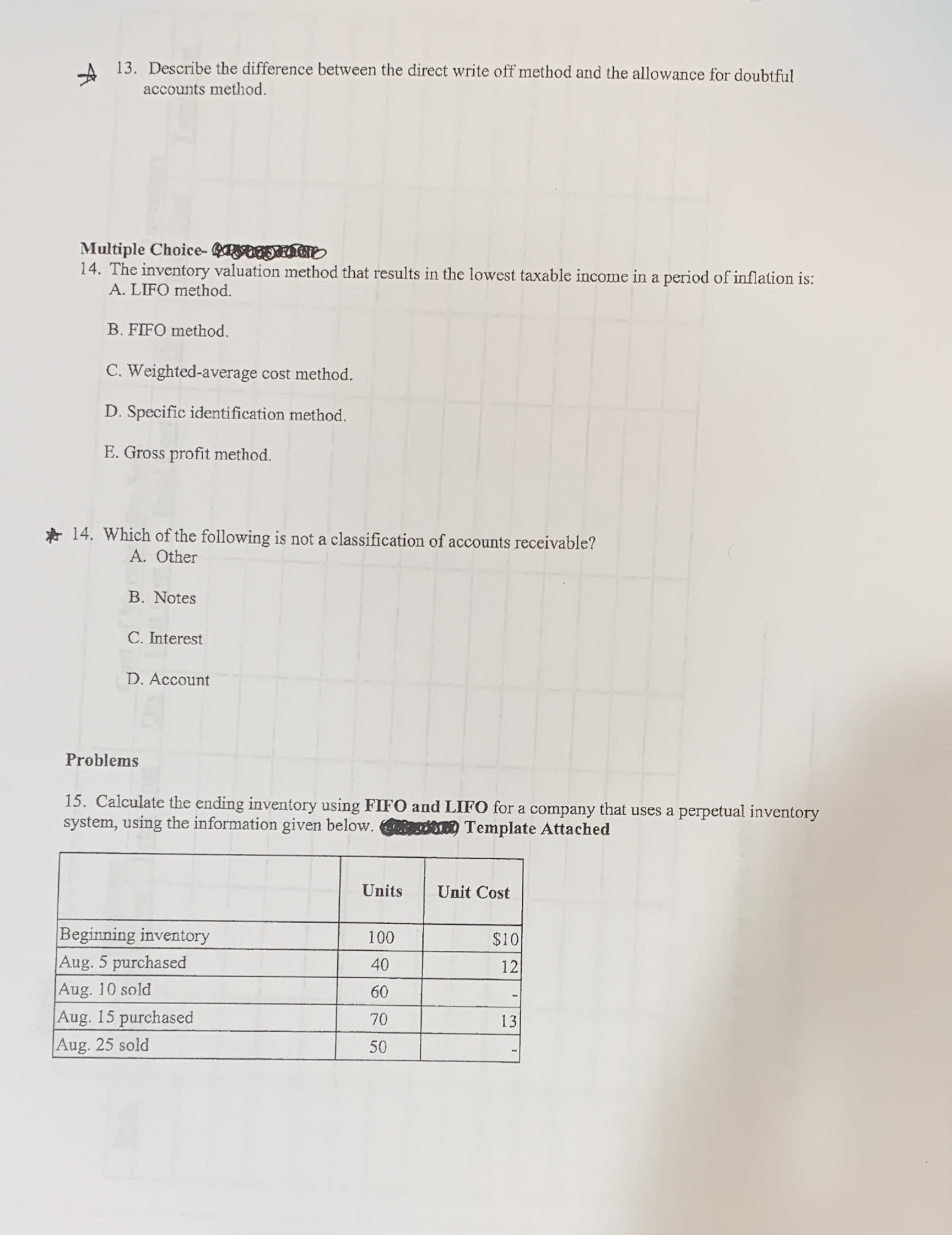

A 13. Describe the difference between the direct write off method and the allowance for doubtful accounts method. Multiple Choice-18085 0615 14. The inventory valuation method that results in the lowest taxable income in a period of inflation is: A. LIFO method. B. FIFO method. C. Weighted-average cost method. D. Specific identification method. E. Gross profit method. * 14. Which of the following is not a classification of accounts receivable? A. Other B. Notes C. Interest D. Account Problems 15. Calculate the ending inventory using FIFO and LIFO for a company that uses a perpetual inventory system, using the information given below. @bought Template Attached Units Unit Cost Beginning inventory 100 $10 Aug. 5 purchased 40 12 Aug. 10 sold 60 Aug. 15 purchased 70 13 Aug. 25 sold 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts