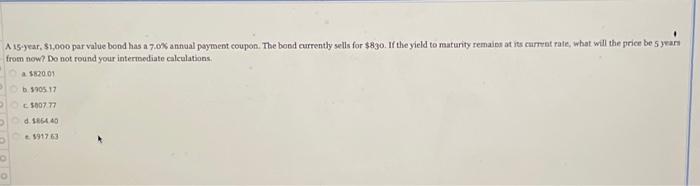

Question: . A 15-year, $1,000 par value bond has a 7.0% annual payment coupon. The band currently sells for $830. If the yield to maturity remains

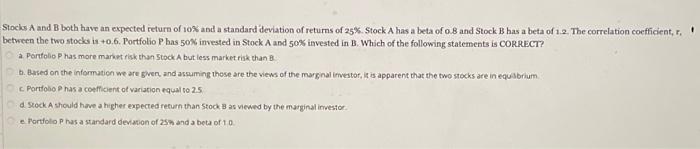

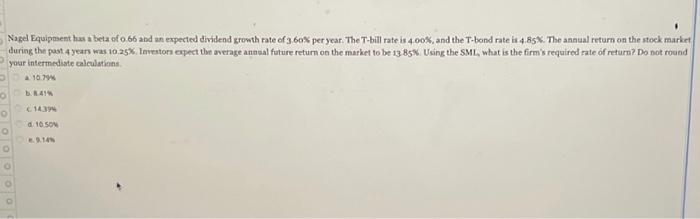

. A 15-year, $1,000 par value bond has a 7.0% annual payment coupon. The band currently sells for $830. If the yield to maturity remains at its current rate, what will the price be s year from now? Do not round your intermediate calculations a $20.01 390517 580777 d. 1440 59176 Stocks A and B both have an expected return of 10% and a standard deviation of returns of 25%. Stock A has a beta of 0.8 and Stock Bhas a beta of 1.2. The correlation coefficient, , between the two stocks in +0.6. Portfolio P has 50% invested in Stock A and 50% invested in B. Which of the following statements is CORRECT? a Portfolio P has more market risk than Stock A but less market risk than B b. Based on the information we are gver, and assuming those are the views of the marginal investor, it is apparent that the two stocks are in equilibrium Portfolio P has a coefficient of variation equal to 25 d Stock A should have a higher expected return than stock as viewed by the marginal investor e Portfolio P has a standard deviation of 25 and a beta of 10 Nagel Equipment has a beta of 0 66 and an expected dividend growth rate of 3.60% per year. The T-bill rate is 4.00%, and the T-band rate is 4.85%. The annual return on the stock market during the past 4 year was 10.25%. Inventorn expect the average annual future return on the market to be 13854. Using the SML, what is the firm's required rate of return? Do not round your intermediate calculations . 16.79 B.1.4 143 O d. 10 SON OOOO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts