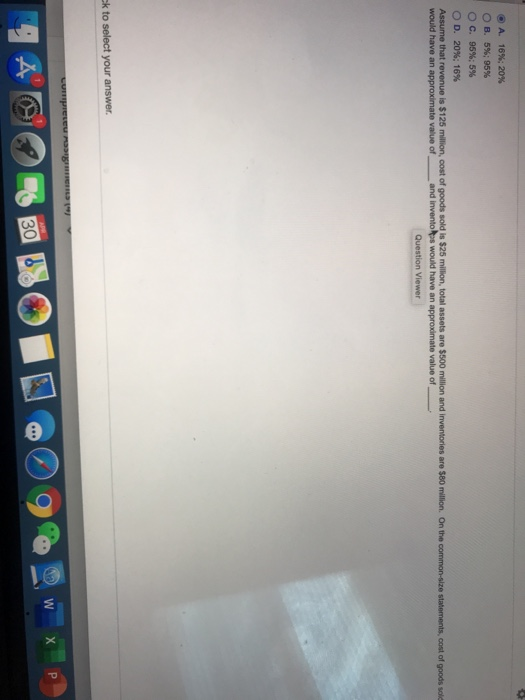

Question: A. 16%: 20% OB. 5%; 95% O c. 95%: 5% OD. 20%: 16% Assume that revenue is $125 million, cost of goods sold is $25

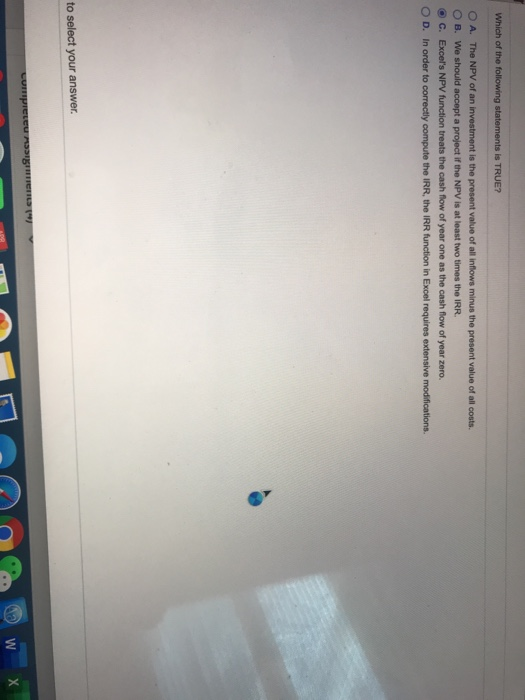

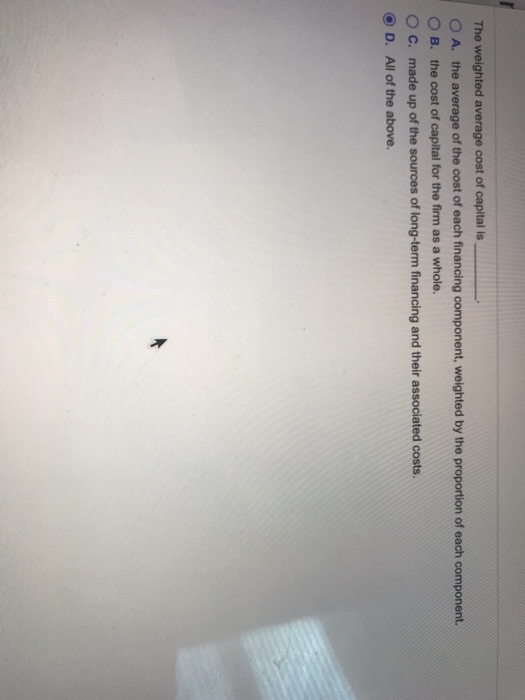

A. 16%: 20% OB. 5%; 95% O c. 95%: 5% OD. 20%: 16% Assume that revenue is $125 million, cost of goods sold is $25 million, total assets are $500 million and inventories are $80 million. On the common size statements, cost of goods solo would have an approximate value of and inventors would have an approximate value of Question Viewer k to select your answer. LUETUS Which of the following statements is TRUE? O A. The NPV of an investment is the present value of all inflows minus the present value of all costs OB. We should accept a project if the NPV is at least two times the IRR. C. Excel's NPV function treats the cash flow of year one as the cash flow of year zero D. In order to correctly compute the IRR, the IRR function in Excel requires extensive modifications O to select your answer. LUPIELTU SISET MONO W X The weighted average cost of capital is O A. the average of the cost of each financing component, weighted by the proportion of each component. O B. the cost of capital for the firm as a whole. O c. made up of the sources of long-term financing and their associated costs. O D. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts