Question: a. 19. After analyzing the bank statement and comparing the details to company records of Blue Company, the following data is found as of February

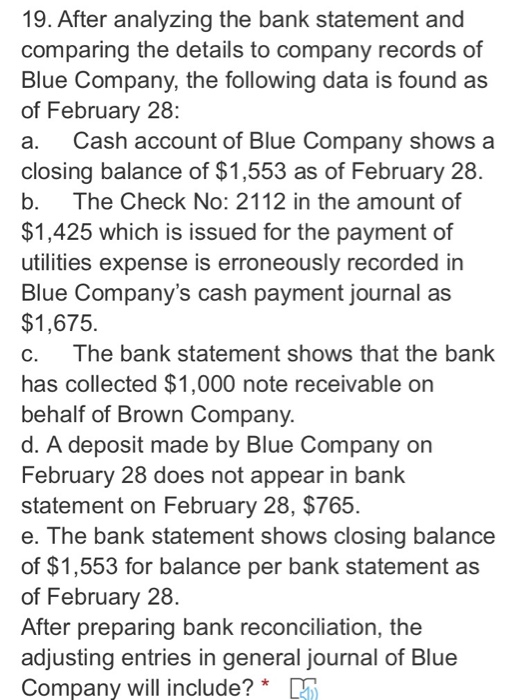

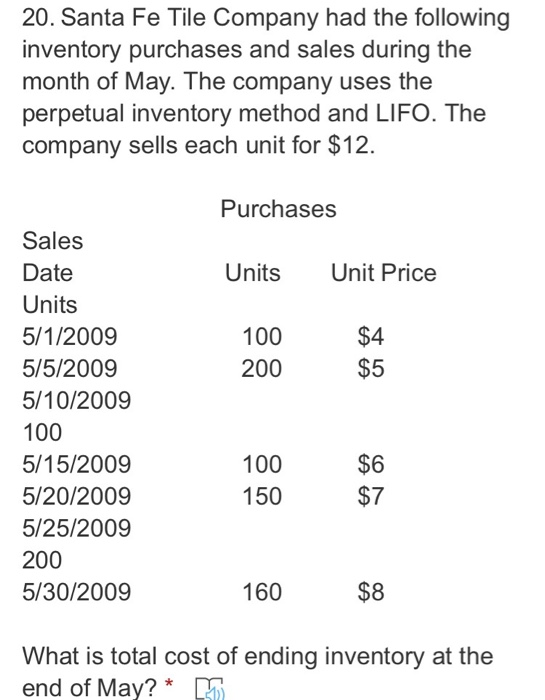

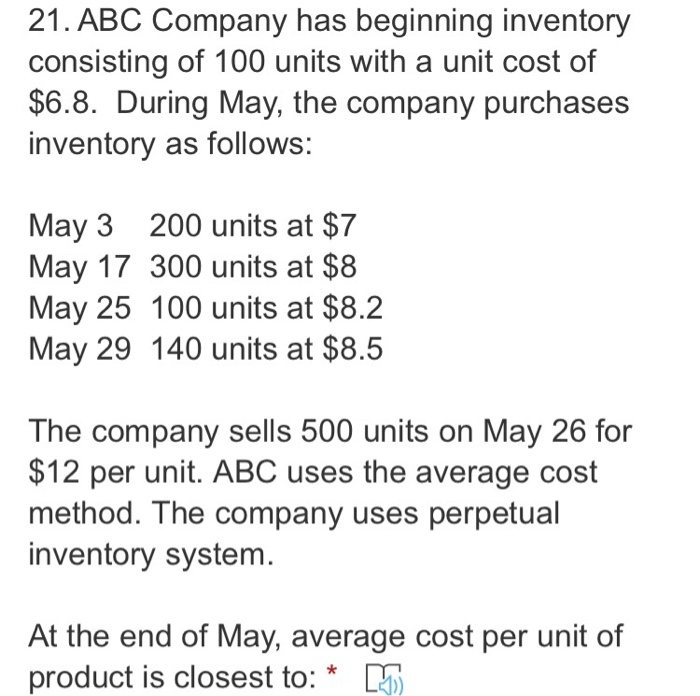

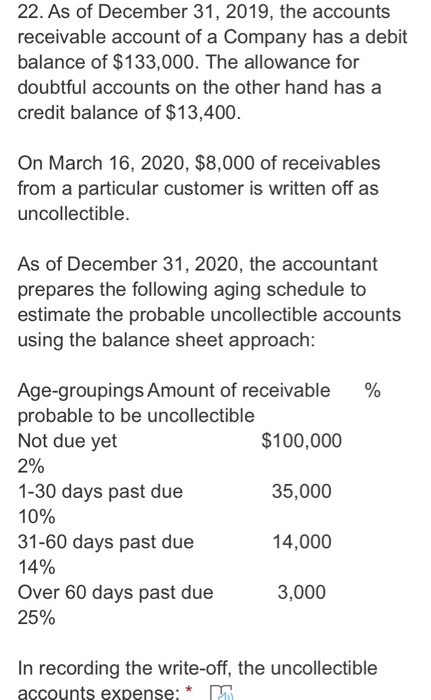

a. 19. After analyzing the bank statement and comparing the details to company records of Blue Company, the following data is found as of February 28: Cash account of Blue Company shows a closing balance of $1,553 as of February 28. b. The Check No: 2112 in the amount of $1,425 which is issued for the payment of utilities expense is erroneously recorded in Blue Company's cash payment journal as $1,675. C. The bank statement shows that the bank has collected $1,000 note receivable on behalf of Brown Company. d. A deposit made by Blue Company on February 28 does not appear in bank statement on February 28, $765. e. The bank statement shows closing balance of $1,553 for balance per bank statement as of February 28. After preparing bank reconciliation, the adjusting entries in general journal of Blue Company will include? * m 21. ABC Company has beginning inventory consisting of 100 units with a unit cost of $6.8. During May, the company purchases inventory as follows: May 3 200 units at $7 May 17 300 units at $8 May 25 100 units at $8.2 May 29 140 units at $8.5 The company sells 500 units on May 26 for $12 per unit. ABC uses the average cost method. The company uses perpetual inventory system. At the end of May, average cost per unit of product is closest to: 22. As of December 31, 2019, the accounts receivable account of a company has a debit balance of $133,000. The allowance for doubtful accounts on the other hand has a credit balance of $13,400. On March 16, 2020, $8,000 of receivables from a particular customer is written off as uncollectible. As of December 31, 2020, the accountant prepares the following aging schedule to estimate the probable uncollectible accounts using the balance sheet approach: % Age-groupings Amount of receivable probable to be uncollectible Not due yet $100,000 2% 1-30 days past due 35,000 10% 31-60 days past due 14,000 14% Over 60 days past due 3,000 25% In recording the write-off, the uncollectible accounts expense; * a. 19. After analyzing the bank statement and comparing the details to company records of Blue Company, the following data is found as of February 28: Cash account of Blue Company shows a closing balance of $1,553 as of February 28. b. The Check No: 2112 in the amount of $1,425 which is issued for the payment of utilities expense is erroneously recorded in Blue Company's cash payment journal as $1,675. C. The bank statement shows that the bank has collected $1,000 note receivable on behalf of Brown Company. d. A deposit made by Blue Company on February 28 does not appear in bank statement on February 28, $765. e. The bank statement shows closing balance of $1,553 for balance per bank statement as of February 28. After preparing bank reconciliation, the adjusting entries in general journal of Blue Company will include? * m 21. ABC Company has beginning inventory consisting of 100 units with a unit cost of $6.8. During May, the company purchases inventory as follows: May 3 200 units at $7 May 17 300 units at $8 May 25 100 units at $8.2 May 29 140 units at $8.5 The company sells 500 units on May 26 for $12 per unit. ABC uses the average cost method. The company uses perpetual inventory system. At the end of May, average cost per unit of product is closest to: 22. As of December 31, 2019, the accounts receivable account of a company has a debit balance of $133,000. The allowance for doubtful accounts on the other hand has a credit balance of $13,400. On March 16, 2020, $8,000 of receivables from a particular customer is written off as uncollectible. As of December 31, 2020, the accountant prepares the following aging schedule to estimate the probable uncollectible accounts using the balance sheet approach: % Age-groupings Amount of receivable probable to be uncollectible Not due yet $100,000 2% 1-30 days past due 35,000 10% 31-60 days past due 14,000 14% Over 60 days past due 3,000 25% In recording the write-off, the uncollectible accounts expense; *

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts