Question: A ) ( 2 0 % ) B ) ( 5 % ) C ) ( 1 5

A

B

C

D

E

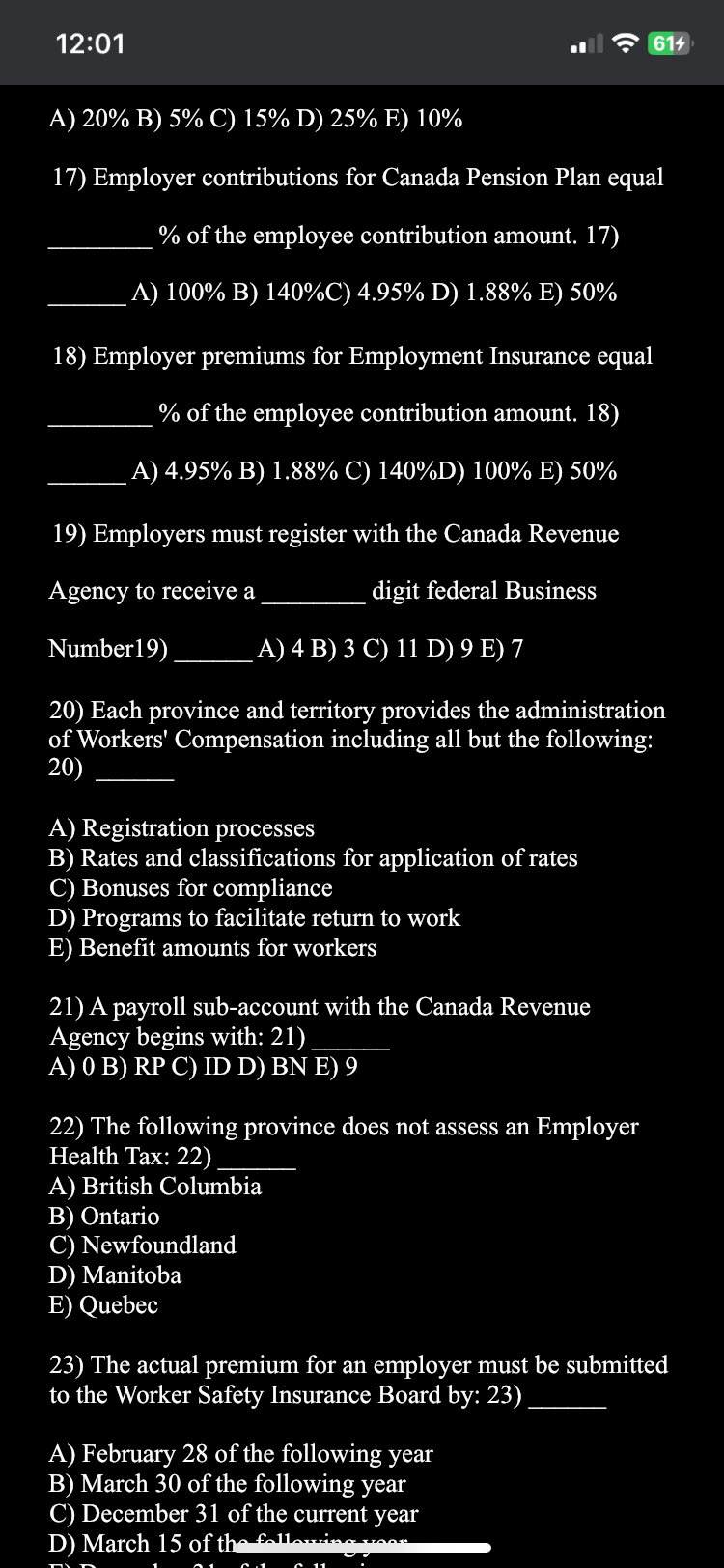

Employer contributions for Canada Pension Plan equal of the employee contribution amount.

A

B

C

D

E

Employer premiums for Employment Insurance equal

of the employee contribution amount.

A

B

C

D

E

Employers must register with the Canada Revenue

Agency to receive digit federal Business

Number A

B

C

D E

Each province and territory provides the administration of Workers' Compensation including all but the following:

A Registration processes

B Rates and classifications for application of rates

C Bonuses for compliance

D Programs to facilitate return to work

E Benefit amounts for workers

A payroll subaccount with the Canada Revenue Agency begins with:

A B RP C ID D BN E

The following province does not assess an Employer Health Tax:

A British Columbia

B Ontario

C Newfoundland

D Manitoba

E Quebec

The actual premium for an employer must be submitted to the Worker Safety Insurance Board by:

A February of the following year

B March of the following year

C December of the current year

D March of th

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock