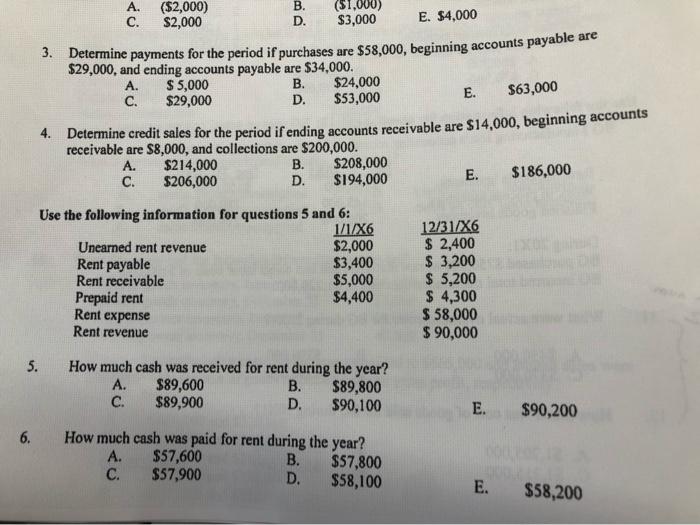

Question: A. ($2,000) B. ($1,000) C. $2,000 D. $3,000 E. $4,000 3. Determine payments for the period if purchases are $58,000, beginning accounts payable are $29,000,

A. ($2,000) B. ($1,000) C. $2,000 D. $3,000 E. $4,000 3. Determine payments for the period if purchases are $58,000, beginning accounts payable are $29,000, and ending accounts payable are $34,000. A. $ 5,000 B. $24,000 C. $29,000 D. $53,000 E. 4. Determine credit sales for the period if ending accounts receivable are $14,000, beginning accounts receivable are $8,000, and collections are $200,000. A. $214,000 B. $208,000 C. $206,000 D. $194,000 E. $186,000 $63,000 Use the following information for questions 5 and 6: 1/1/X6 Unearned rent revenue $2,000 Rent payable $3,400 Rent receivable $5,000 Prepaid rent $4,400 Rent expense Rent revenue 12/31/X6 $ 2,400 $ 3,200 $ 5,200 $ 4,300 $ 58,000 $ 90,000 5. How much cash was received for rent during the year? A. $89,600 B. $89,800 C. $89,900 D. $90,100 E. $90,200 6. How much cash was paid for rent during the year? A. $57,600 B. $57,800 C. $57,900 D. $58,100 E. $58,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts