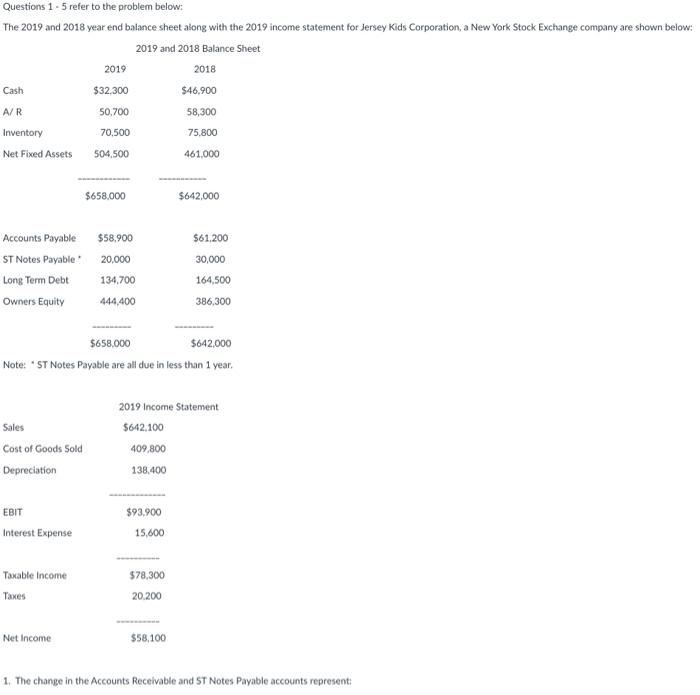

Question: a 2018 Questions 1 - 5 refer to the problem below: The 2019 and 2018 year end balance sheet along with the 2019 income statement

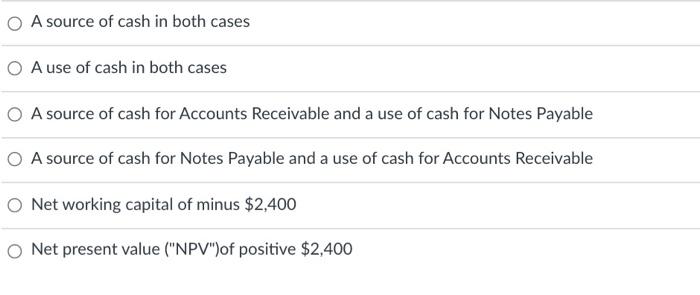

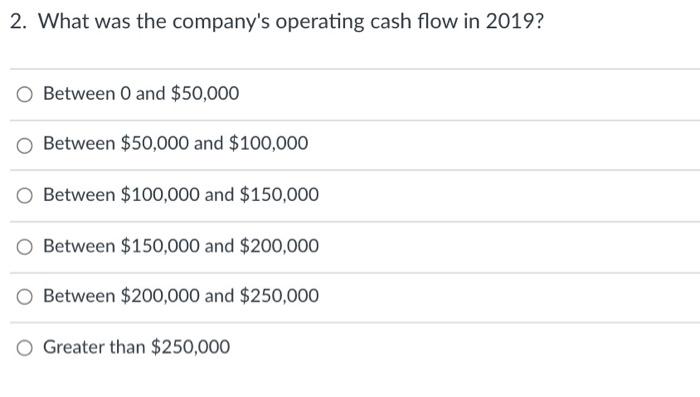

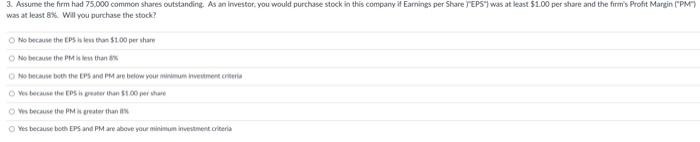

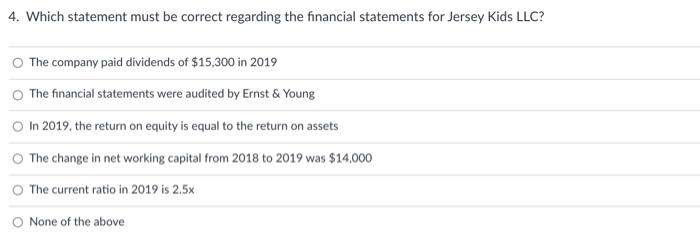

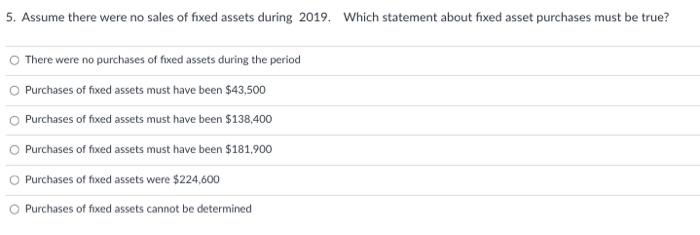

a 2018 Questions 1 - 5 refer to the problem below: The 2019 and 2018 year end balance sheet along with the 2019 income statement for Jersey Kids Corporation, a New York Stock Exchange company are shown below: 2019 and 2018 Balance Sheet 2019 Cash $32,300 $46.900 AR 50,700 58,300 Inventory 70,500 75,800 Net Fixed Assets 504,500 461,000 $658.000 $642,000 $58.900 $61,200 20.000 30,000 Accounts Payable ST Notes Payable Long Term Debt Owners Equity 134.700 444,400 164,500 386,300 $658.000 $642,000 Note: * ST Notes Payable are all due in less than 1 year. Sales Cost of Goods Sold Depreciation 2019 Income Statement $642.100 409,800 138,400 EBIT Interest Expense $93,900 15,600 Taxable income $78,300 20.200 Taxes Net Income $58,100 1. The change in the Accounts Receivable and ST Notes Payable accounts representi A source of cash in both cases O A use of cash in both cases O A source of cash for Accounts Receivable and a use of cash for Notes Payable O A source of cash for Notes Payable and a use of cash for Accounts Receivable O Net working capital of minus $2,400 Net present value ("NPV")of positive $2,400 2. What was the company's operating cash flow in 2019? Between 0 and $50,000 Between $50,000 and $100,000 Between $100,000 and $150,000 Between $150,000 and $200,000 Between $200,000 and $250,000 O Greater than $250,000 3. Assume the firm had 75,000 common shares outstanding. As an investor, you would purchase stock in this company it Earnings per Share TEPS") was at least 51.00 per share and the firm's Profit Margin ("PM") was at least 8% Will you purchase the stock? No because these than $1.00 per than No because the PM than No because both the EPS and PM are below your mum hvement citer Yes because the water than $1.00 h Ves because the PM is greater than was because both EPS and PM are above your minimum investment criteria 4. Which statement must be correct regarding the financial statements for Jersey Kids LLC? The company paid dividends of $15,300 in 2019 The financial statements were audited by Ernst & Young In 2019, the return on equity is equal to the return on assets The change in net working capital from 2018 to 2019 was $14,000 The current ratio in 2019 is 2.5x None of the above 5. Assume there were no sales of fixed assets during 2019, Which statement about fixed asset purchases must be true? There were no purchases of fixed assets during the period Purchases of fixed assets must have been $43,500 Purchases of fixed assets must have been $138,400 Purchases of fixed assets must have been $181.900 Purchases of fixed assets were $224,600 Purchases of fixed assets cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts