Question: A 20-year bond is issued today with a face value of $1,000. The bond pays semi-annual coupon at 5% p.a. (nominal). The issue price gives

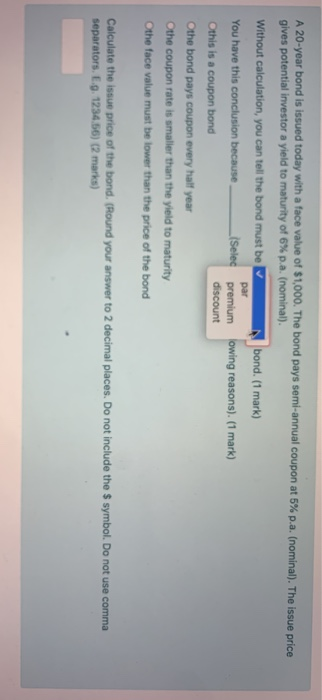

A 20-year bond is issued today with a face value of $1,000. The bond pays semi-annual coupon at 5% p.a. (nominal). The issue price gives potential investor a yield to maturity of 6% p.a. (nominal). Without calculation, you can tell the bond must be bond. (1 mark) par You have this conclusion because Selec premium owing reasons) (1 mark) Othis is a coupon bond discount Othe bond pays coupon every half year the coupon rate is smaller than the yield to maturity Othe face value must be lower than the price of the bond Calculate the issue price of the bond. (Round your answer to 2 decimal places. Do not include the $ symbol. Do not use comma separators. E.9. 1234,56) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts