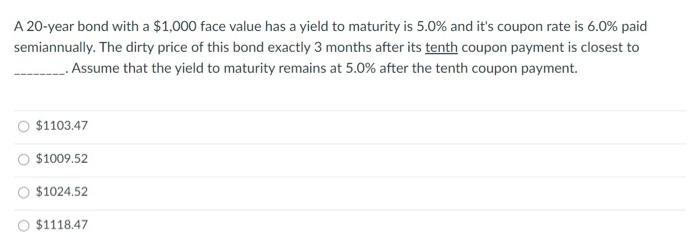

Question: A 20-year bond with a $1,000 face value has a yield to maturity is 5.0% and it's coupon rate is 6.0% paid semiannually. The dirty

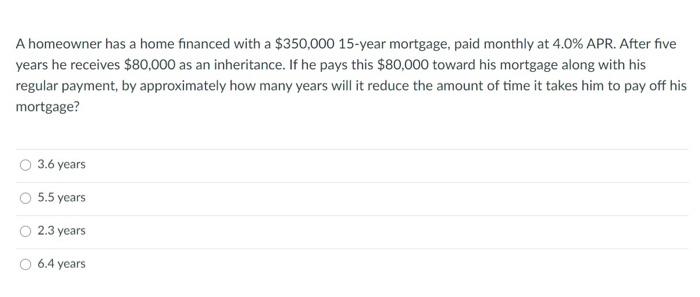

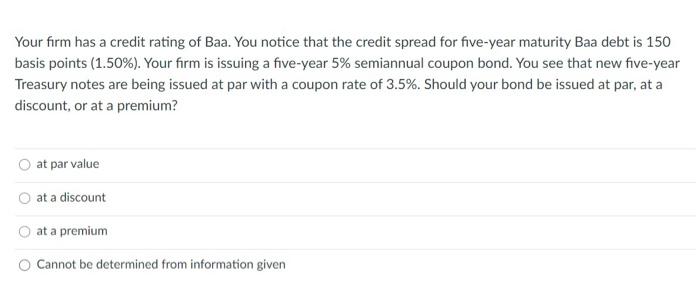

A 20-year bond with a $1,000 face value has a yield to maturity is 5.0% and it's coupon rate is 6.0% paid semiannually. The dirty price of this bond exactly 3 months after its tenth coupon payment is closest to . Assume that the yield to maturity remains at 5.0% after the tenth coupon payment $1103.47 $1009.52 $1024.52 $1118.47 A homeowner has a home financed with a $350,000 15-year mortgage, paid monthly at 4.0% APR. After five years he receives $80,000 as an inheritance. If he pays this $80,000 toward his mortgage along with his regular payment, by approximately how many years will it reduce the amount of time it takes him to pay off his mortgage? 3.6 years 5.5 years 2.3 years 6.4 years Your firm has a credit rating of Baa. You notice that the credit spread for five-year maturity Baa debt is 150 basis points (1.50%). Your firm is issuing a five-year 5% semiannual coupon bond. You see that new five-year Treasury notes are being issued at par with a coupon rate of 3.5%. Should your bond be issued at par, at a discount, or at a premium? at par value at a discount a premium Cannot be determined from information given

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts