Question: A 22. A PP Lili Normal N Heading 1 Heading 2 Heading 3 Heading 4 12 Variable Cost/unit (in dollars) 17 12 11 Table 1

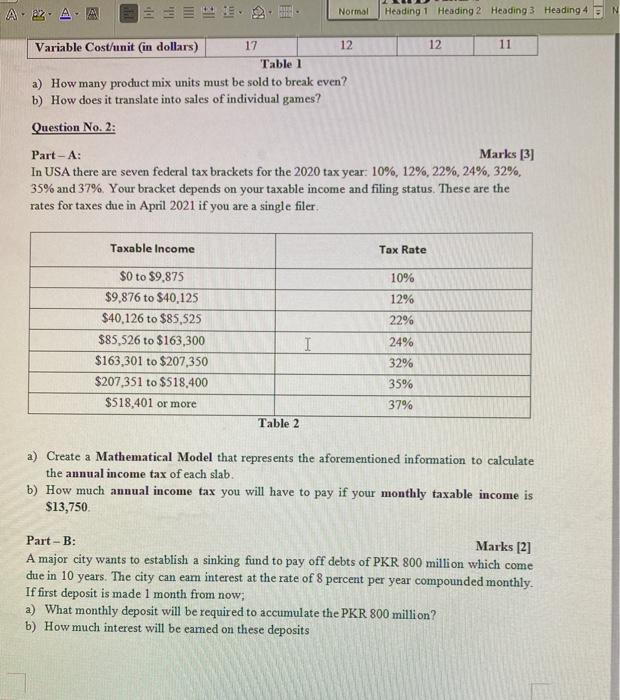

A 22. A PP Lili Normal N Heading 1 Heading 2 Heading 3 Heading 4 12 Variable Cost/unit (in dollars) 17 12 11 Table 1 a) How many product mix units must be sold to break even? b) How does it translate into sales of individual games? Question No. 2: Part-A: Marks [3] In USA there are seven federal tax brackets for the 2020 tax year: 10%, 12%, 22%, 24%, 32%. 35% and 37%. Your bracket depends on your taxable income and filing status. These are the rates for taxes due in April 2021 if you are a single filer. Taxable income Tax Rate 10% 12% 22% $0 to $9.875 $9,876 to $40.125 $40,126 to $85,525 $85,526 to $163,300 $163,301 to $207,350 $207,351 to $518,400 $518,401 or more I 24% 32% 35% 37% Table 2 a) Create a Mathematical Model that represents the aforementioned information to calculate the aunual income tax of each slab. b) How much annual income tax you will have to pay if your monthly taxable income is $13,750 Part-B: Marks [2] A major city wants to establish a sinking fund to pay off debts of PKR 800 million which come due in 10 years. The city can eam interest at the rate of 8 percent per year compounded monthly If first deposit is made 1 month from now, a) What monthly deposit will be required to accumulate the PKR 800 million? b) How much interest will be eamed on these deposits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts