Question: a) (2.5 marks) Using the market for reserves graph, show what will happen to the federal funds rate in equilibrium if the central bank performs

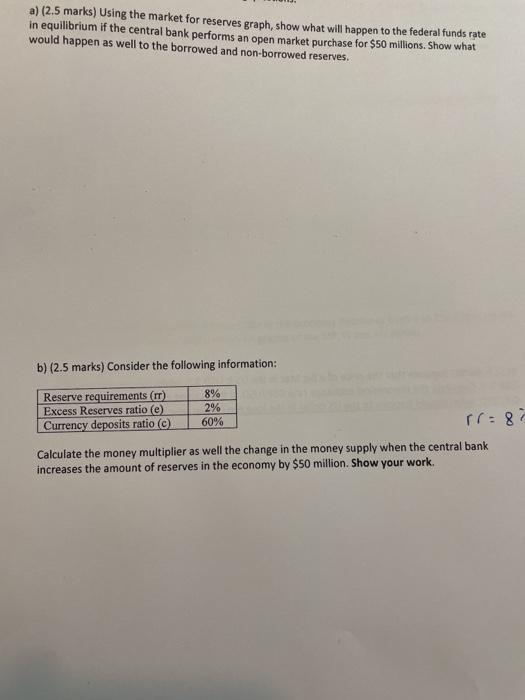

a) (2.5 marks) Using the market for reserves graph, show what will happen to the federal funds rate in equilibrium if the central bank performs an open market purchase for $50 millions. Show what would happen as well to the borrowed and non-borrowed reserves. b) (2.5 marks) Consider the following information: Reserve requirements (IT) 8% Excess Reserves ratio (e) 2% Currency deposits ratio (C) 60% r6=87 Calculate the money multiplier as well the change in the money supply when the central bank increases the amount of reserves in the economy by $50 million. Show your work, a) (2.5 marks) Using the market for reserves graph, show what will happen to the federal funds rate in equilibrium if the central bank performs an open market purchase for $50 millions. Show what would happen as well to the borrowed and non-borrowed reserves. b) (2.5 marks) Consider the following information: Reserve requirements (IT) 8% Excess Reserves ratio (e) 2% Currency deposits ratio (C) 60% r6=87 Calculate the money multiplier as well the change in the money supply when the central bank increases the amount of reserves in the economy by $50 million. Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts