Question: A 25-year bond has a face amount (and maturity value) of 1,000. It pays semi-annual coupons at an 8% (annual) coupon rate. The bond

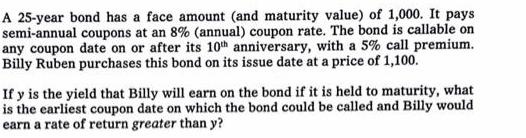

A 25-year bond has a face amount (and maturity value) of 1,000. It pays semi-annual coupons at an 8% (annual) coupon rate. The bond is callable on any coupon date on or after its 10th anniversary, with a 5% call premium. Billy Ruben purchases this bond on its issue date at a price of 1,100. If y is the yield that Billy will earn on the bond if it is held to maturity, what is the earliest coupon date on which the bond could be called and Billy would earn a rate of return greater than y?

Step by Step Solution

3.48 Rating (165 Votes )

There are 3 Steps involved in it

To determine the earliest coupon date on which the bond could be called and Billy would earn a rate of return greater than y we need to compare the yi... View full answer

Get step-by-step solutions from verified subject matter experts