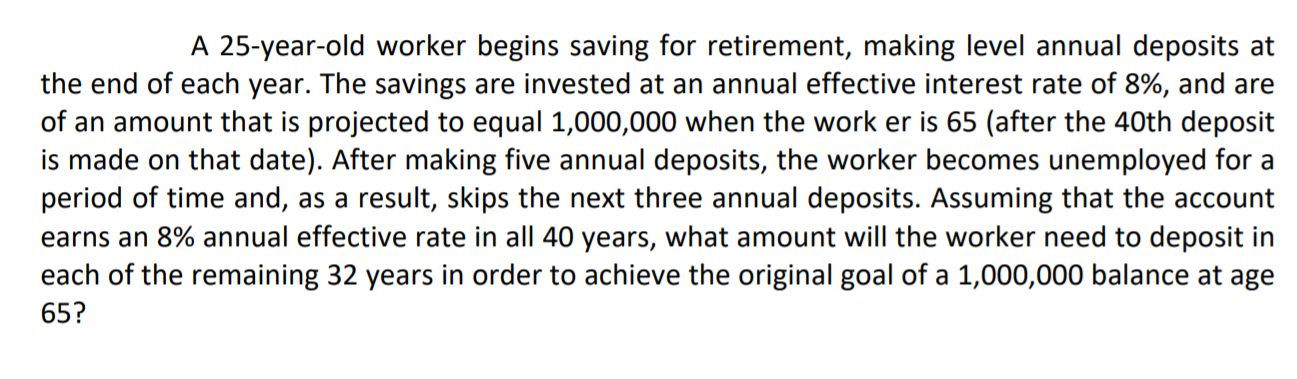

Question: A 25-year-old worker begins saving for retirement, making level annual deposits at the end of each year. The savings are invested at an annual effective

A 25-year-old worker begins saving for retirement, making level annual deposits at the end of each year. The savings are invested at an annual effective interest rate of 8%, and are of an amount that is projected to equal 1,000,000 when the work er is 65 (after the 40th deposit is made on that date). After making five annual deposits, the worker becomes unemployed for a period of time and, as a result, skips the next three annual deposits. Assuming that the account earns an 8% annual effective rate in all 40 years, what amount will the worker need to deposit in each of the remaining 32 years in order to achieve the original goal of a 1,000,000 balance at age 65

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts