Question: A. 27.19% B. 12.52% C. 24.02% D. 20.01% E. 15.96% F. 25.40% Question 12 (3 points) Lakhme Corpn is evaluating a project based on MIRR.

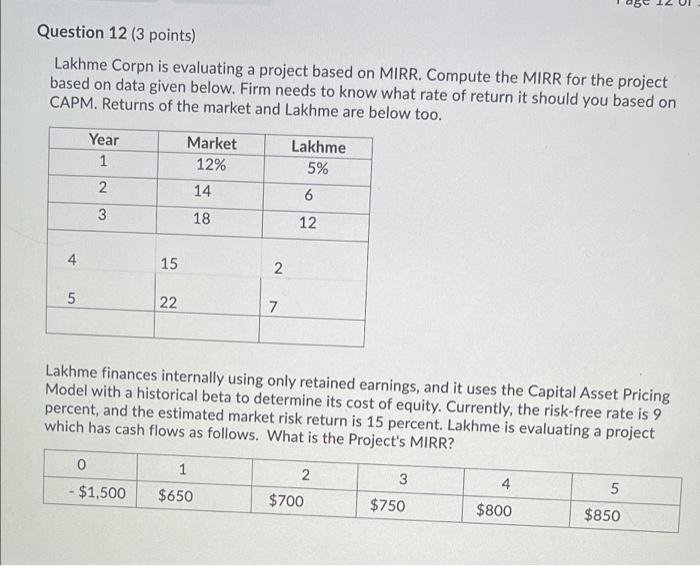

Question 12 (3 points) Lakhme Corpn is evaluating a project based on MIRR. Compute the MIRR for the project based on data given below. Firm needs to know what rate of return it should you based on CAPM. Returns of the market and Lakhme are below too. Year 1 Market 12% Lakhme 5% 2 14 6 3 18 12 4 4 15 2 5 22 7 Lakhme finances internally using only retained earnings, and it uses the Capital Asset Pricing Model with a historical beta to determine its cost of equity. Currently, the risk-free rate is 9 percent, and the estimated market risk return is 15 percent. Lakhme is evaluating a project which has cash flows as follows. What is the Project's MIRR? 1 0 - $1,500 2 3 4 $650 $700 $750 $800 5 $850 Question 12 (3 points) Lakhme Corpn is evaluating a project based on MIRR. Compute the MIRR for the project based on data given below. Firm needs to know what rate of return it should you based on CAPM. Returns of the market and Lakhme are below too. Year 1 Market 12% Lakhme 5% 2 14 6 3 18 12 4 4 15 2 5 22 7 Lakhme finances internally using only retained earnings, and it uses the Capital Asset Pricing Model with a historical beta to determine its cost of equity. Currently, the risk-free rate is 9 percent, and the estimated market risk return is 15 percent. Lakhme is evaluating a project which has cash flows as follows. What is the Project's MIRR? 1 0 - $1,500 2 3 4 $650 $700 $750 $800 5 $850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts