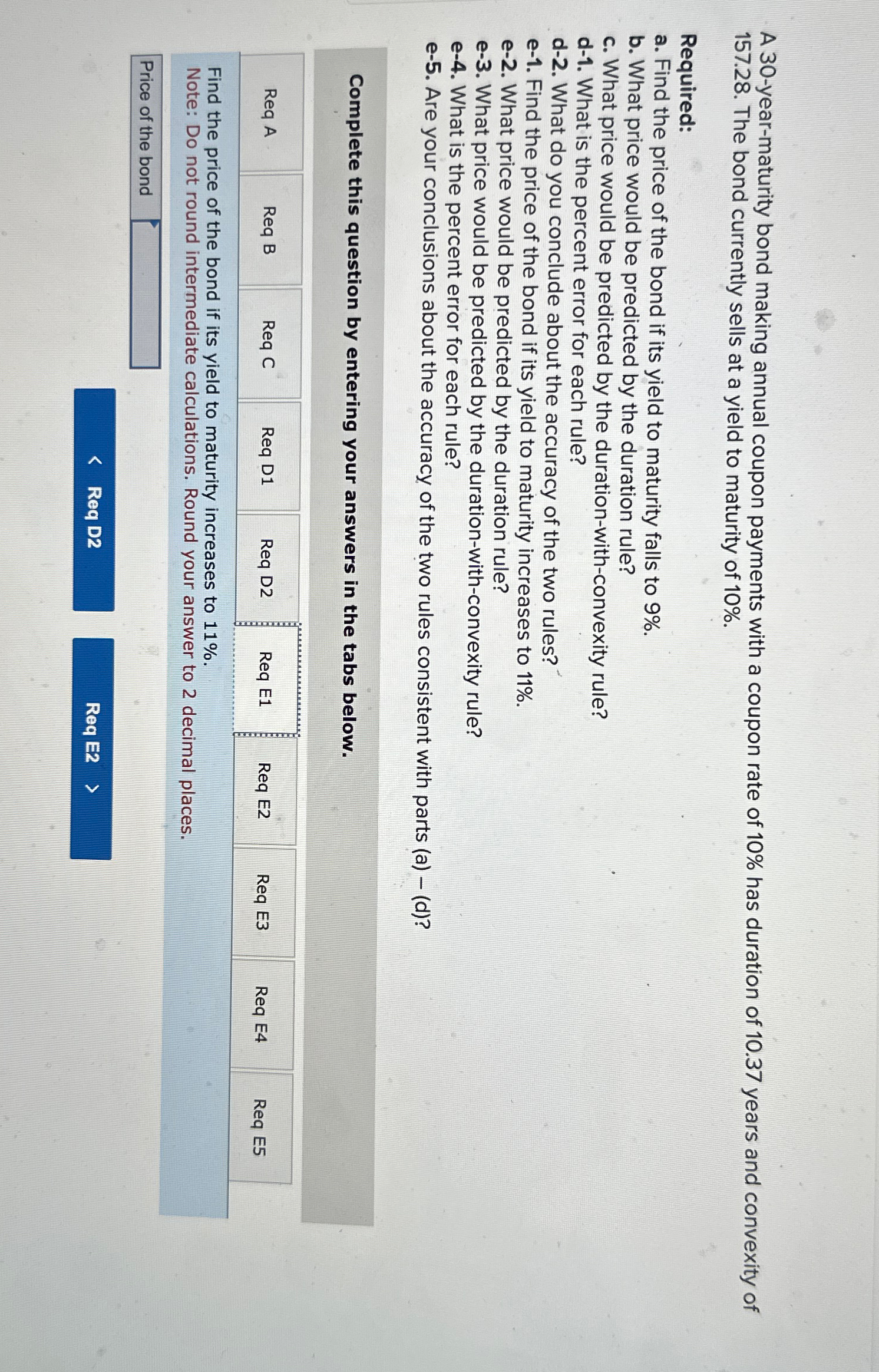

Question: A 3 0 - year - maturity bond making annual coupon payments with a coupon rate of 1 0 % has duration of 1 0

A yearmaturity bond making annual coupon payments with a coupon rate of has duration of years and convexity of The bond currently sells at a yield to maturity of

Required:

a Find the price of the bond if its yield to maturity falls to

b What price would be predicted by the duration rule?

c What price would be predicted by the durationwithconvexity rule?

d What is the percent error for each rule?

d What do you conclude about the accuracy of the two rules?

e Find the price of the bond if its yield to maturity increases to

e What price would be predicted by the duration rule?

e What price would be predicted by the durationwithconvexity rule?

e What is the percent error for each rule?

e Are your conclusions about the accuracy of the two rules consistent with parts ad

Complete this question by entering your answers in the tabs below.

Price of the bond

NEED ANSWERS FOR REA EE ONLY

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock