Question: a. 3. Consider a project with free cash flows in one year of $130,000 or $180,000, with each outcome being equally likely. The initial investment

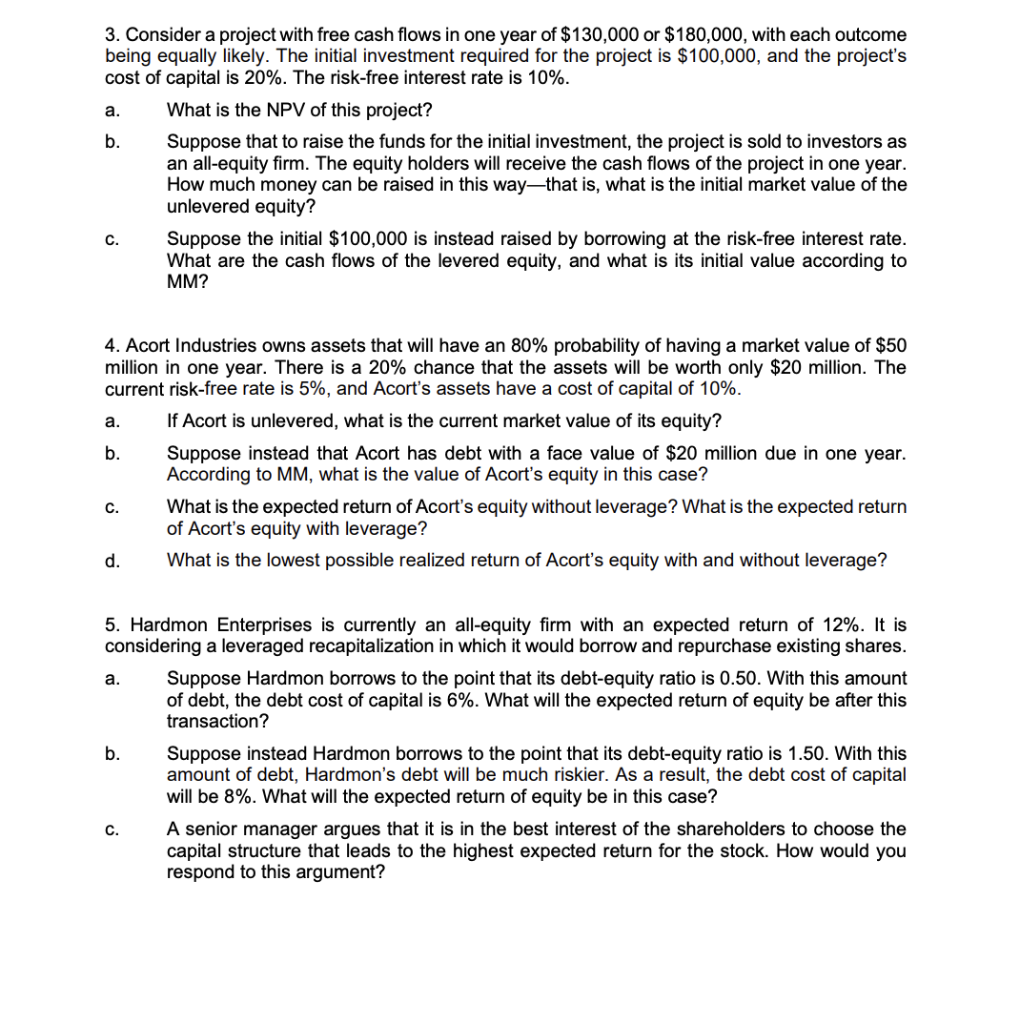

a. 3. Consider a project with free cash flows in one year of $130,000 or $180,000, with each outcome being equally likely. The initial investment required for the project is $100,000, and the project's cost of capital is 20%. The risk-free interest rate is 10%. What is the NPV of this project? b. Suppose that to raise the funds for the initial investment, the project is sold to investors as an all-equity firm. The equity holders will receive the cash flows of the project in one year. How much money can be raised in this waythat is, what is the initial market value of the unlevered equity? Suppose the initial $100,000 is instead raised by borrowing at the risk-free interest rate. What are the cash flows of the levered equity, and what is its initial value according to MM? C. a. 4. Acort Industries owns assets that will have an 80% probability of having a market value of $50 million in one year. There is a 20% chance that the assets will be worth only $20 million. The current risk-free rate is 5%, and Acort's assets have a cost of capital of 10%. If Acort is unlevered, what is the current market value of its equity? b. Suppose instead that Acort has debt with a face value of $20 million due in one year. According to MM, what is the value of Acort's equity in this case? What is the expected return of Acort's equity without leverage? What is the expected return of Acort's equity with leverage? d. What is the lowest possible realized return of Acort's equity with and without leverage? C. a. 5. Hardmon Enterprises is currently an all-equity firm with an expected return of 12%. It is considering a leveraged recapitalization in which it would borrow and repurchase existing shares. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 6%. What will the expected return of equity be after this transaction? b. Suppose instead Hardmon borrows to the point that its debt-equity ratio is 1.50. With this amount of debt, Hardmon's debt will be much riskier. As a result, the debt cost of capital will be 8%. What will the expected return of equity be in this case? A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected return for the stock. How would you respond to this argument? c. a. 3. Consider a project with free cash flows in one year of $130,000 or $180,000, with each outcome being equally likely. The initial investment required for the project is $100,000, and the project's cost of capital is 20%. The risk-free interest rate is 10%. What is the NPV of this project? b. Suppose that to raise the funds for the initial investment, the project is sold to investors as an all-equity firm. The equity holders will receive the cash flows of the project in one year. How much money can be raised in this waythat is, what is the initial market value of the unlevered equity? Suppose the initial $100,000 is instead raised by borrowing at the risk-free interest rate. What are the cash flows of the levered equity, and what is its initial value according to MM? C. a. 4. Acort Industries owns assets that will have an 80% probability of having a market value of $50 million in one year. There is a 20% chance that the assets will be worth only $20 million. The current risk-free rate is 5%, and Acort's assets have a cost of capital of 10%. If Acort is unlevered, what is the current market value of its equity? b. Suppose instead that Acort has debt with a face value of $20 million due in one year. According to MM, what is the value of Acort's equity in this case? What is the expected return of Acort's equity without leverage? What is the expected return of Acort's equity with leverage? d. What is the lowest possible realized return of Acort's equity with and without leverage? C. a. 5. Hardmon Enterprises is currently an all-equity firm with an expected return of 12%. It is considering a leveraged recapitalization in which it would borrow and repurchase existing shares. Suppose Hardmon borrows to the point that its debt-equity ratio is 0.50. With this amount of debt, the debt cost of capital is 6%. What will the expected return of equity be after this transaction? b. Suppose instead Hardmon borrows to the point that its debt-equity ratio is 1.50. With this amount of debt, Hardmon's debt will be much riskier. As a result, the debt cost of capital will be 8%. What will the expected return of equity be in this case? A senior manager argues that it is in the best interest of the shareholders to choose the capital structure that leads to the highest expected return for the stock. How would you respond to this argument? c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts