Question: A 3 year-old a computer-controlled fabric cutting machine, which had a $25,000 purchasing price, has a current market (trade-in) value of $12,000 and expected O&M

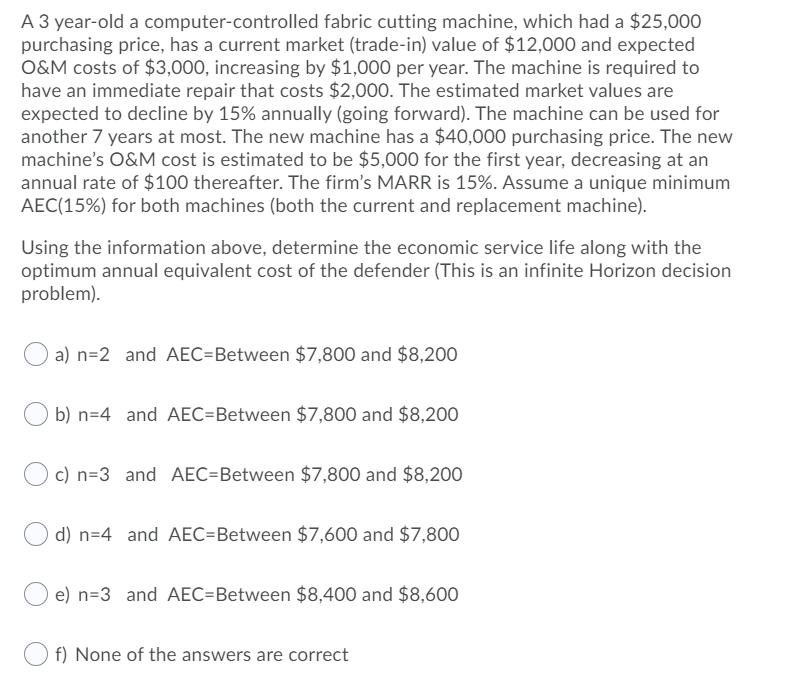

A 3 year-old a computer-controlled fabric cutting machine, which had a $25,000 purchasing price, has a current market (trade-in) value of $12,000 and expected O&M costs of $3,000, increasing by $1,000 per year. The machine is required to have an immediate repair that costs $2,000. The estimated market values are expected to decline by 15% annually (going forward). The machine can be used for another 7 years at most. The new machine has a $40,000 purchasing price. The new machine's O&M cost is estimated to be $5,000 for the first year, decreasing at an annual rate of $100 thereafter. The firm's MARR is 15%. Assume a unique minimum AEC(15%) for both machines (both the current and replacement machine). Using the information above, determine the economic service life along with the optimum annual equivalent cost of the defender (This is an infinite Horizon decision problem). a) n=2 and AEC=Between $7,800 and $8,200 b) n=4 and AEC=Between $7,800 and $8,200 c) n=3 and AEC=Between $7,800 and $8,200 d) n=4 and AEC=Between $7,600 and $7,800 e) n=3 and AEC=Between $8,400 and $8,600 f) None of the answers are correct A 3 year-old a computer-controlled fabric cutting machine, which had a $25,000 purchasing price, has a current market (trade-in) value of $12,000 and expected O&M costs of $3,000, increasing by $1,000 per year. The machine is required to have an immediate repair that costs $2,000. The estimated market values are expected to decline by 15% annually (going forward). The machine can be used for another 7 years at most. The new machine has a $40,000 purchasing price. The new machine's O&M cost is estimated to be $5,000 for the first year, decreasing at an annual rate of $100 thereafter. The firm's MARR is 15%. Assume a unique minimum AEC(15%) for both machines (both the current and replacement machine). Using the information above, determine the economic service life along with the optimum annual equivalent cost of the defender (This is an infinite Horizon decision problem). a) n=2 and AEC=Between $7,800 and $8,200 b) n=4 and AEC=Between $7,800 and $8,200 c) n=3 and AEC=Between $7,800 and $8,200 d) n=4 and AEC=Between $7,600 and $7,800 e) n=3 and AEC=Between $8,400 and $8,600 f) None of the answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts