Question: a) 30. TUCC Ltd is installing a new ICT facility (including a data centre) to enable it better manage its student database and information

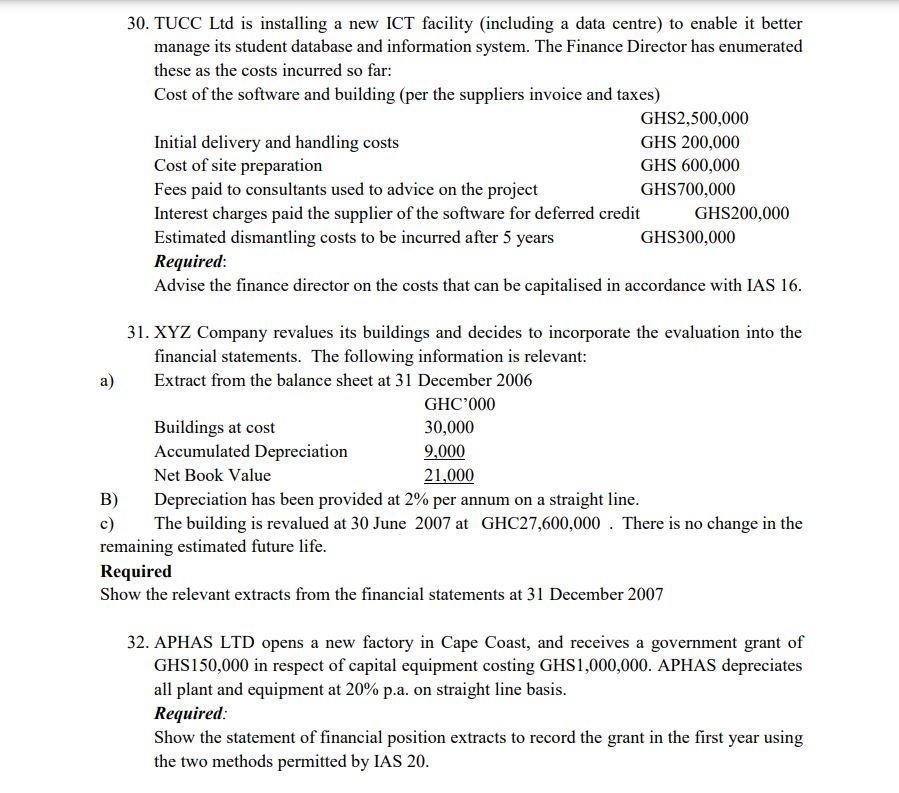

a) 30. TUCC Ltd is installing a new ICT facility (including a data centre) to enable it better manage its student database and information system. The Finance Director has enumerated these as the costs incurred so far: Cost of the software and building (per the suppliers invoice and taxes) B) c) Initial delivery and handling costs Cost of site preparation GHS2,500,000 GHS 200,000 GHS 600,000 GHS700,000 Fees paid to consultants used to advice on the project Interest charges paid the supplier of the software for deferred credit Estimated dismantling costs to be incurred after 5 years Required: Advise the finance director on the costs that can be capitalised in accordance with IAS 16. Buildings at cost Accumulated Depreciation Net Book Value GHS200,000 GHS300,000 31. XYZ Company revalues its buildings and decides to incorporate the evaluation into the financial statements. The following information is relevant: Extract from the balance sheet at 31 December 2006 GHC'000 30,000 9,000 21,000 Depreciation has been provided at 2% per annum on a straight line. The building is revalued at 30 June 2007 at GHC27,600,000. There is no change in the remaining estimated future life. Required Show the relevant extracts from the financial statements at 31 December 2007 32. APHAS LTD opens a new factory in Cape Coast, and receives a government grant of GHS150,000 in respect of capital equipment costing GHS1,000,000. APHAS depreciates all plant and equipment at 20% p.a. on straight line basis. Required: Show the statement of financial position extracts to record the grant in the first year using the two methods permitted by IAS 20.

Step by Step Solution

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step 1 Answer 30 The accounting treatment for the Property Plant and Equipment is defined in IAS 16 ... View full answer

Get step-by-step solutions from verified subject matter experts