Question: A 30 -year Treasury bond is issued with face value of $1,000, paying interest of $60 per year. If market yields increase shortly after the

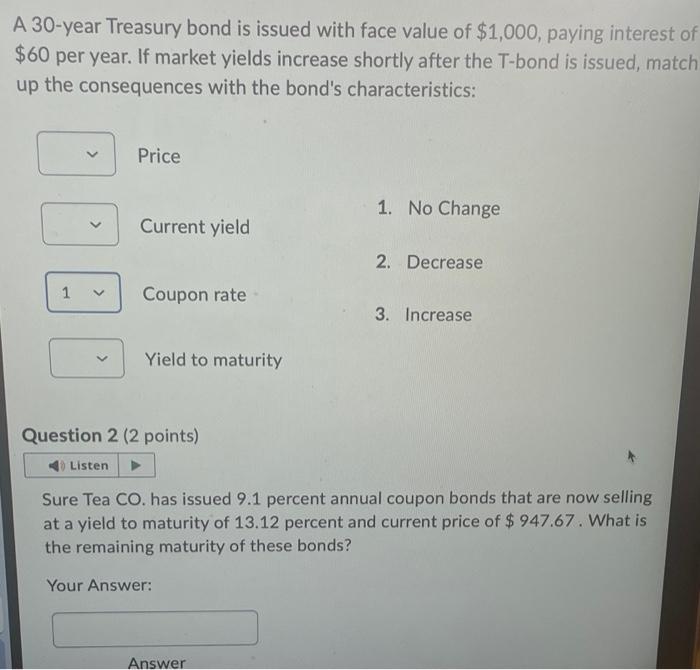

A 30 -year Treasury bond is issued with face value of $1,000, paying interest of $60 per year. If market yields increase shortly after the T-bond is issued, match up the consequences with the bond's characteristics: Price Current yield 1. No Change 2. Decrease Coupon rate 3. Increase Yield to maturity Question 2 ( 2 points) Sure Tea CO. has issued 9.1 percent annual coupon bonds that are now selling at a yield to maturity of 13.12 percent and current price of $947.67. What is the remaining maturity of these bonds? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts