Question: A 30-year ARM with 2 points ($100,000 note amount) is offered with an initial interest rate of 3.75% based on the 1-year Treasury Index that

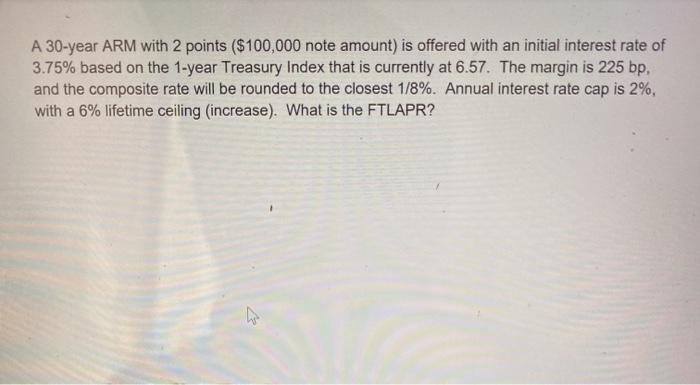

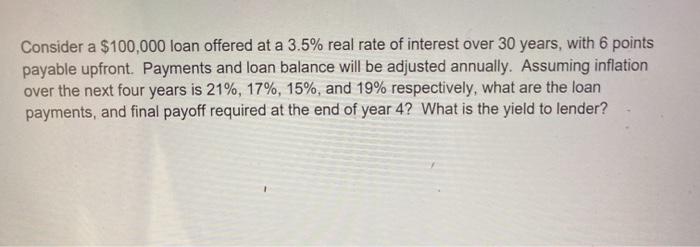

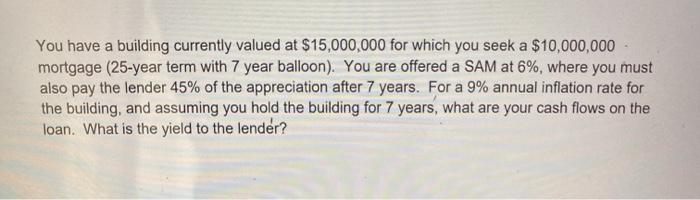

A 30-year ARM with 2 points ($100,000 note amount) is offered with an initial interest rate of 3.75% based on the 1-year Treasury Index that is currently at 6.57. The margin is 225 bp, and the composite rate will be rounded to the closest 1/8%. Annual interest rate cap is 2%, with a 6% lifetime ceiling (increase). What is the FTLAPR? w Consider a $100,000 loan offered at a 3.5% real rate of interest over 30 years, with 6 points payable upfront. Payments and loan balance will be adjusted annually. Assuming inflation over the next four years is 21%, 17%, 15%, and 19% respectively, what are the loan payments, and final payoff required at the end of year 4? What is the yield to lender? You have a building currently valued at $15,000,000 for which you seek a $10,000,000 mortgage (25-year term with 7 year balloon). You are offered a SAM at 6%, where you must also pay the lender 45% of the appreciation after 7 years. For a 9% annual inflation rate for the building, and assuming you hold the building for 7 years, what are your cash flows on the loan. What is the yield to the lender? A 30-year ARM with 2 points ($100,000 note amount) is offered with an initial interest rate of 3.75% based on the 1-year Treasury Index that is currently at 6.57. The margin is 225 bp, and the composite rate will be rounded to the closest 1/8%. Annual interest rate cap is 2%, with a 6% lifetime ceiling (increase). What is the FTLAPR? w Consider a $100,000 loan offered at a 3.5% real rate of interest over 30 years, with 6 points payable upfront. Payments and loan balance will be adjusted annually. Assuming inflation over the next four years is 21%, 17%, 15%, and 19% respectively, what are the loan payments, and final payoff required at the end of year 4? What is the yield to lender? You have a building currently valued at $15,000,000 for which you seek a $10,000,000 mortgage (25-year term with 7 year balloon). You are offered a SAM at 6%, where you must also pay the lender 45% of the appreciation after 7 years. For a 9% annual inflation rate for the building, and assuming you hold the building for 7 years, what are your cash flows on the loan. What is the yield to the lender

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts