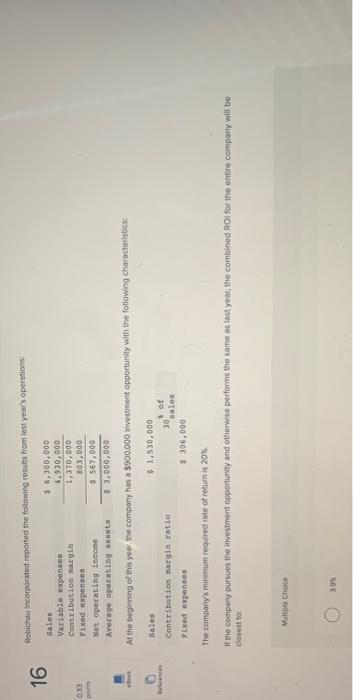

Question: A. 3.9% B. 24.0% C. 14.5% D. 18.5% Robichau Incorporated reported the following results from fast year's operations 16 0.33 Sales $6,300,000 Variable expenses 4,930,000

Robichau Incorporated reported the following results from fast year's operations 16 0.33 Sales $6,300,000 Variable expenses 4,930,000 Contribution margin 1.370,000 Fixed expenses 103,000 Net operating income $ 567,000 Average operating assets 3,000,000 At the beginning of this yew the company has a $900,000 investment opportunity with the following characteristics Sales Contribution margin ratio Fixed expenses $ 1.530,000 of 30 sales $306,000 The company's minimum required rate of return is 20% If the company pursues the investment opportunity and otherwise performs the same as lost year, the combined ROI for the entire company will be dosent to We Choice 39

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts