Question: A 3-year forward contract on Mathcorp shares is to be issued. The current share price is 4.50 and the last dividend which was paid

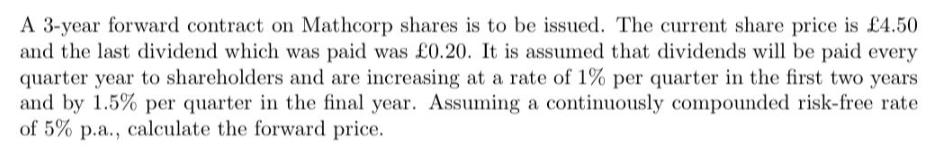

A 3-year forward contract on Mathcorp shares is to be issued. The current share price is 4.50 and the last dividend which was paid was 0.20. It is assumed that dividends will be paid every quarter year to shareholders and are increasing at a rate of 1% per quarter in the first two years and by 1.5% per quarter in the final year. Assuming a continuously compounded risk-free rate of 5% p.a., calculate the forward price.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

First lets calculate the future dividends For the first two years Div... View full answer

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock