Question: A. 4 5 6 Spread Duration in concept is the same of Duration, however is measure price sensitivity to a change in spreads. Spread Duration

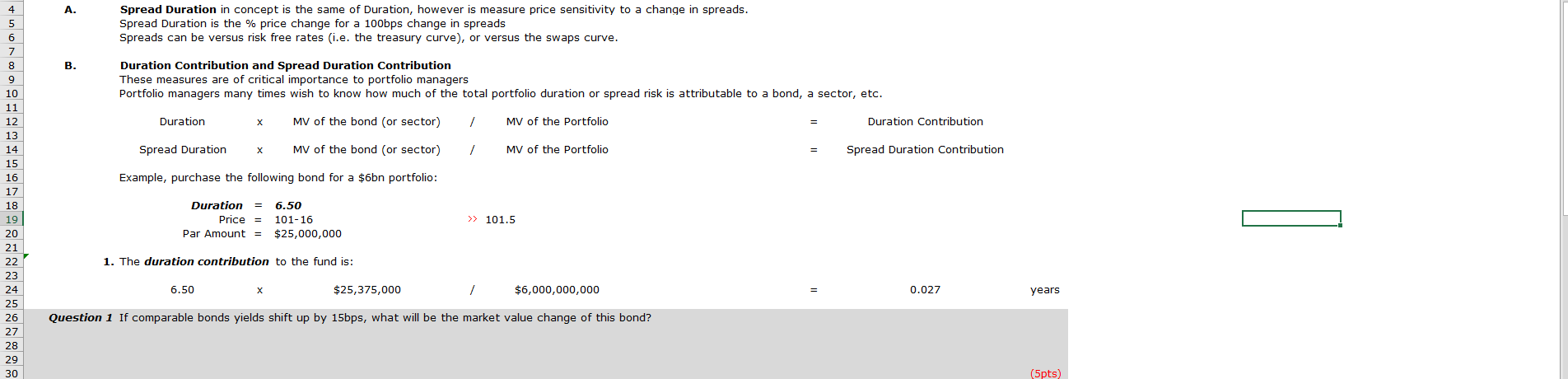

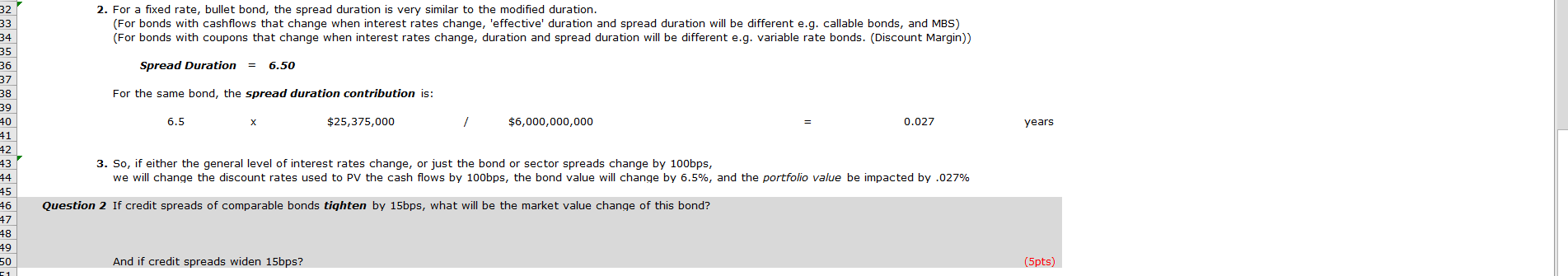

A. 4 5 6 Spread Duration in concept is the same of Duration, however is measure price sensitivity to a change in spreads. Spread Duration is the % price change for a 100bps change in spreads Spreads can be versus risk free rates (i.e. the treasury curve), or versus the swaps curve. 7 8 9 B. Duration Contribution and Spread Duration Contribution These measures are of critical importance to portfolio managers Portfolio managers many times wish to know how much of the total portfolio duration or spread risk is attributable to a bond, a sector, etc. Duration X MV of the bond (or sector) / MV of the Portfolio Duration Contribution Spread Duration MV of the bond (or sector) / MV of the Portfolio = Spread Duration Contribution Example, purchase the following bond for a $6bn portfolio: 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Duration = 6.50 Price = 101-16 Par Amount = $25,000,000 >> 101.5 1. The duration contribution to the fund is: 6.50 x $25,375,000 / $6,000,000,000 0.027 years Question 1 If comparable bonds yields shift up by 15bps, what will be the market value change of this bond? (5pts) 2. For a fixed rate, bullet bond, the spread duration is very similar to the modified duration. (For bonds with cashflows that change when interest rates change, 'effective' duration and spread duration will be different e.g. callable bonds, and MBS) (For bonds with coupons that change when interest rates change, duration and spread duration will be different e.g. variable rate bonds. (Discount Margin)) Spread Duration = 6.50 For the same bond, the spread duration contribution is: 6.5 $25,375,000 $6,000,000,000 0.027 years 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 3. So, if either the general level of interest rates change, or just the bond or sector spreads change by 100bps, we will change the discount rates used to PV the cash flows by 100bps, the bond value will change by 6.5%, and the portfolio value be impacted by .027% Question 2 If credit spreads of comparable bonds tighten by 15bps, what will be the market value change of this bond? And if credit spreads widen 15bps? (5pts) A. 4 5 6 Spread Duration in concept is the same of Duration, however is measure price sensitivity to a change in spreads. Spread Duration is the % price change for a 100bps change in spreads Spreads can be versus risk free rates (i.e. the treasury curve), or versus the swaps curve. 7 8 9 B. Duration Contribution and Spread Duration Contribution These measures are of critical importance to portfolio managers Portfolio managers many times wish to know how much of the total portfolio duration or spread risk is attributable to a bond, a sector, etc. Duration X MV of the bond (or sector) / MV of the Portfolio Duration Contribution Spread Duration MV of the bond (or sector) / MV of the Portfolio = Spread Duration Contribution Example, purchase the following bond for a $6bn portfolio: 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Duration = 6.50 Price = 101-16 Par Amount = $25,000,000 >> 101.5 1. The duration contribution to the fund is: 6.50 x $25,375,000 / $6,000,000,000 0.027 years Question 1 If comparable bonds yields shift up by 15bps, what will be the market value change of this bond? (5pts) 2. For a fixed rate, bullet bond, the spread duration is very similar to the modified duration. (For bonds with cashflows that change when interest rates change, 'effective' duration and spread duration will be different e.g. callable bonds, and MBS) (For bonds with coupons that change when interest rates change, duration and spread duration will be different e.g. variable rate bonds. (Discount Margin)) Spread Duration = 6.50 For the same bond, the spread duration contribution is: 6.5 $25,375,000 $6,000,000,000 0.027 years 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 3. So, if either the general level of interest rates change, or just the bond or sector spreads change by 100bps, we will change the discount rates used to PV the cash flows by 100bps, the bond value will change by 6.5%, and the portfolio value be impacted by .027% Question 2 If credit spreads of comparable bonds tighten by 15bps, what will be the market value change of this bond? And if credit spreads widen 15bps? (5pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts