Question: a) (4 marks) Seacraft Carriers is considering two alternative cargo ships. Ship A has an expected life of 7 years, will cost $60 million, and

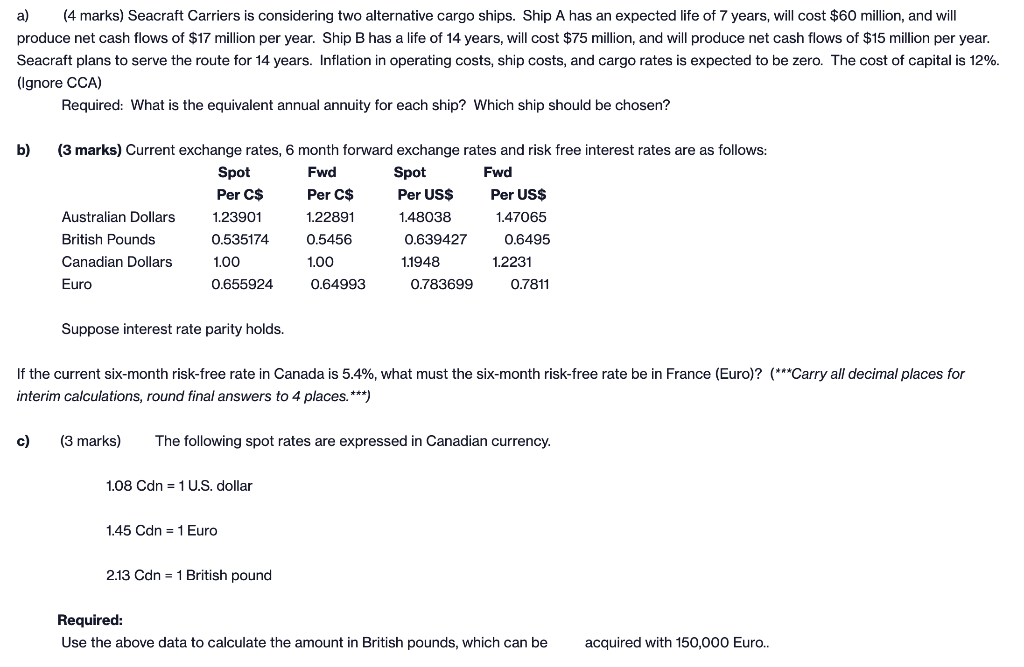

a) (4 marks) Seacraft Carriers is considering two alternative cargo ships. Ship A has an expected life of 7 years, will cost $60 million, and will produce net cash flows of $17 million per year. Ship B has a life of 14 years, will cost $75 million, and will produce net cash flows of $15 million per year. Seacraft plans to serve the route for 14 years. Inflation in operating costs, ship costs, and cargo rates is expected to be zero. The cost of capital is 12%. (Ignore CCA) Required: What is the equivalent annual annuity for each ship? Which ship should be chosen? b) (3 marks) Current exchange rates, 6 month forward exchange rates and risk free interest rates are as follows: Spot Fwd Spot Fwd Per C$ Per C$ Per US$ Per US$ Australian Dollars 1.23901 1.22891 1.48038 1.47065 British Pounds 0.535174 0.5456 0.639427 0.6495 Canadian Dollars 1.00 1.00 1.1948 1.2231 Euro 0.655924 0.64993 0.783699 0.7811 Suppose interest rate parity holds. If the current six-month risk-free rate in Canada is 5.4%, what must the six-month risk-free rate be in France (Euro)? (***Carry all decimal places for interim calculations, round final answers to 4 places. ***) c) (3 marks) The following spot rates are expressed in Canadian currency. 1.08 Cdn = 1 U.S. dollar 1.45 Cdn = 1 Euro 2.13 Cdn = 1 British pound Required: Use the above data to calculate the amount in British pounds, which can be acquired with 150,000 Euro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts