Question: a. (4 points) You purchased a zero coupon bond one year ago for $249.95. The market interest rate is now 9 percent (please keep in

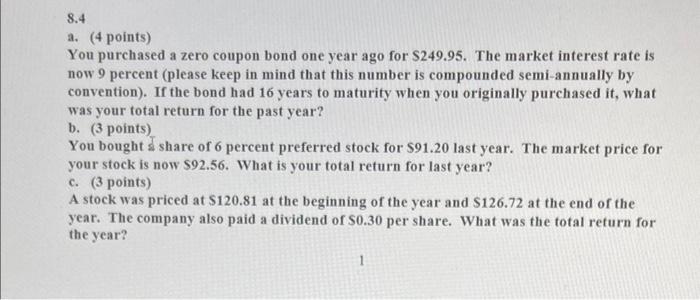

a. (4 points) You purchased a zero coupon bond one year ago for \$249.95. The market interest rate is now 9 percent (please keep in mind that this number is compounded semi-annually by convention). If the bond had 16 years to maturity when you originally purchased it, what was your total return for the past year? b. (3 points) You bought \& share of 6 percent preferred stock for $91.20 last year. The market price for your stock is now $92.56. What is your total return for last year? c. (3 points) A stock was priced at $120.81 at the beginning of the year and $126.72 at the end of the year. The company also paid a dividend of $0.30 per share. What was the total return for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts