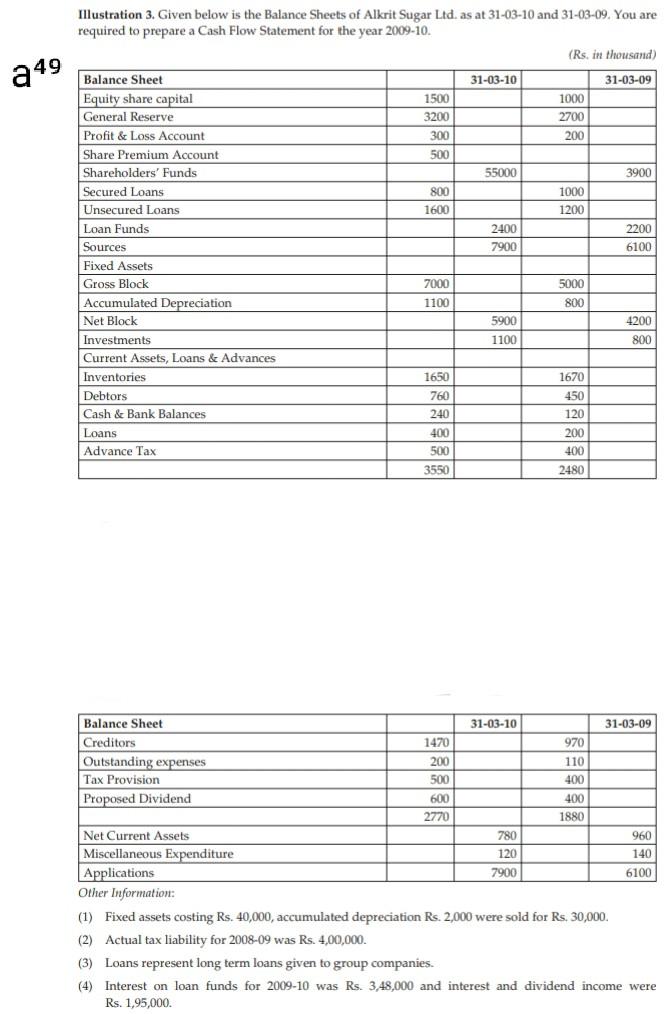

Question: a 49 Illustration 3. Given below is the Balance Sheets of Alkrit Sugar Ltd. as at 31-03-10 and 31-03-09. You are required to prepare a

a 49 Illustration 3. Given below is the Balance Sheets of Alkrit Sugar Ltd. as at 31-03-10 and 31-03-09. You are required to prepare a Cash Flow Statement for the year 2009-10. (Rs. in thousand) Balance Sheet 31-03-10 31-03-09 Equity share capital 1500 1000 General Reserve 3200 2700 Profit & Loss Account 300 200 Share Premium Account 500 Shareholders' Funds 55000 3900 Secured Loans 800 1000 Unsecured Loans 1600 1200 Loan Funds 2400 2200 Sources 7900 6100 Fixed Assets Gross Block 7000 5000 Accumulated Depreciation 1100 800 Net Block 5900 4200 Investments 1100 800 Current Assets, Loans & Advances Inventories 1650 1670 Debtors 760 450 Cash & Bank Balances 240 120 Loans 400 200 Advance Tax 500 400 3550 2480 Balance Sheet 31-03-10 31-03-09 Creditors 1470 970 Outstanding expenses 200 110 Tax Provision 500 400 Proposed Dividend 600 400 2770 1880 Net Current Assets 780 960 Miscellaneous Expenditure 120 140 Applications 7900 6100 Other Information: (1) Fixed assets costing Rs. 40,000, accumulated depreciation Rs. 2,000 were sold for Rs. 30,000 (2) Actual tax liability for 2008-09 was Rs. 4,00,000. (3) Loans represent long term loans given to group companies. (4) Interest on loan funds for 2009-10 was Rs. 3,48,000 and interest and dividend income were Rs. 1,95,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts