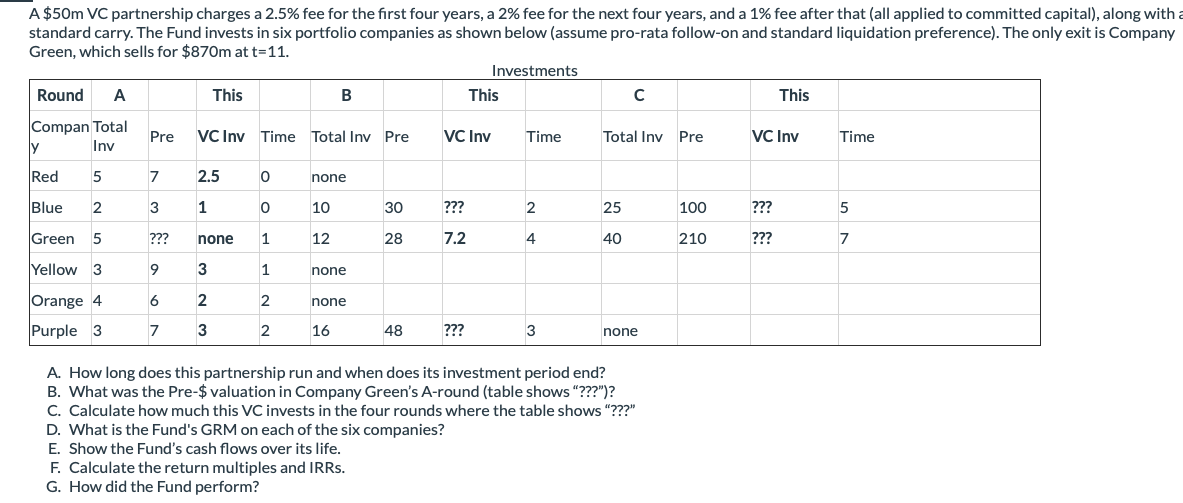

Question: A $ 5 0 m VC partnership charges a 2 . 5 % fee for the first four years, a 2 % fee for the

A $ VC partnership charges a fee for the first four years, a fee for the next four years, and a fee after that all applied to committed capital along with a

standard carry. The Fund invests in six portfolio companies as shown below assume prorata followon and standard liquidation preference The only exit is Company

Green, which sells for $ at

Investments

A How long does this partnership run and when does its investment period end?

B What was the Pre$ valuation in Company Green's Around table shows

C Calculate how much this VC invests in the four rounds where the table shows

D What is the Fund's GRM on each of the six companies?

E Show the Fund's cash flows over its life.

F Calculate the return multiples and IRRs.

G How did the Fund perform?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock