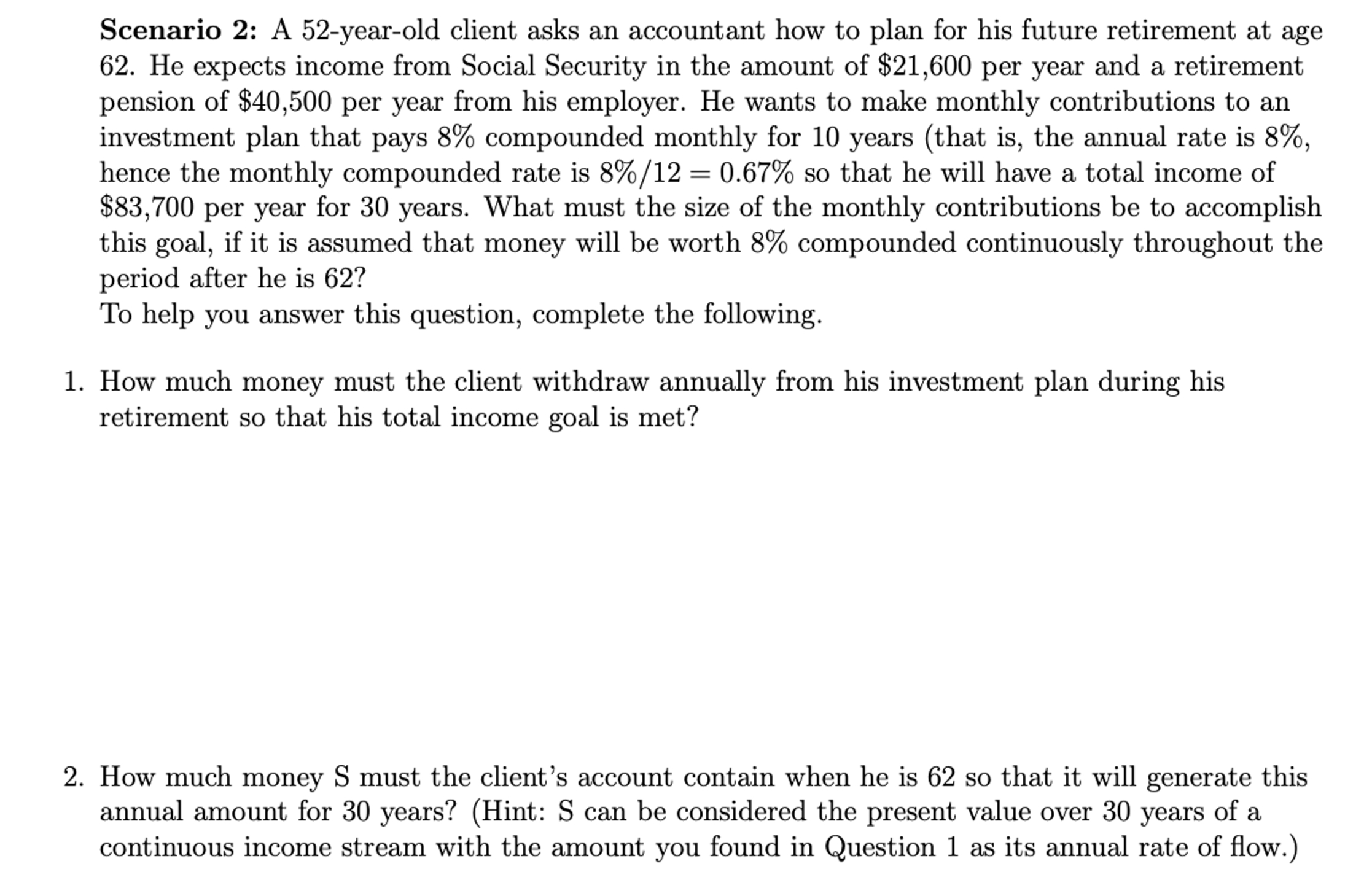

Question: A 5 2 - year - old client asks an accountant how to plan for his future retirement at age 6 2 . He expects

A yearold client asks an accountant how to plan for his future retirement at age

He expects income from Social Security in the amount of $ per year and a retirement

pension of $ per year from his employer. He wants to make monthly contributions to an

investment plan that pays compounded monthly for years that is the annual rate is

hence the monthly compounded rate is so that he will have a total income of

$ per year for years. What must the size of the monthly contributions be to accomplish

this goal, if it is assumed that money will be worth compounded continuously throughout the

period after he is

To help you answer this question, complete the following.

How much money must the client withdraw annually from his investment plan during his

retirement so that his total income goal is met?How much money S must the client's account contain when he is so that it will generate this

annual amount for years? Hint: S can be considered the present value over years of a

continuous income stream with the amount you found in Question as its annual rate of flow.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock