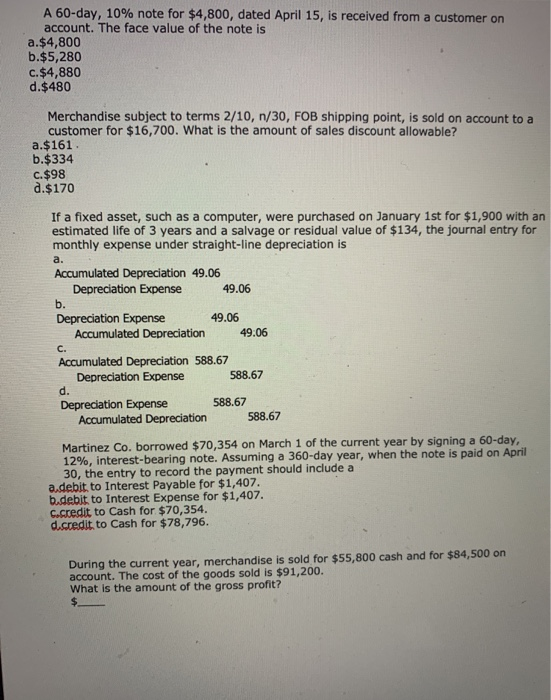

Question: A 60-day, 10% note for $4,800, dated April 15, is received from a customer on account. The face value of the note is a.$4,800 b.$5,280

A 60-day, 10% note for $4,800, dated April 15, is received from a customer on account. The face value of the note is a.$4,800 b.$5,280 c. $4,880 d.$480 a. Merchandise subject to terms 2/10, n/30, FOB shipping point, is sold on account to a customer for $16,700. What is the amount of sales discount allowable? a $161 b.$334 c. $98 a.$170 If a fixed asset, such as a computer, were purchased on January 1st for $1,900 with an estimated life of 3 years and a salvage or residual value of $134, the journal entry for monthly expense under straight-line depreciation is Accumulated Depreciation 49.06 Depreciation Expense 49.06 b. Depreciation Expense 49.06 Accumulated Depreciation 49.06 Accumulated Depreciation 588.67 Depreciation Expense 588.67 d. Depreciation Expense 588.67 Accumulated Depreciation 588.67 C. Martinez Co. borrowed $70,354 on March 1 of the current year by signing a 60-day, 12%, interest-bearing note. Assuming a 360-day year, when the note is paid on April 30, the entry to record the payment should include a a debit to Interest Payable for $1,407. b.debit to Interest Expense for $1,407. c.credit to Cash for $70,354. d.credit to Cash for $78,796. During the current year, merchandise is sold for $55,800 cash and for $84,500 on account. The cost of the goods sold is $91,200. What is the amount of the gross profit? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts