Question: A 60-day, 12% note for $10,000, dated May 1, is received from a customer on account. If the note is discounted on May 21 at

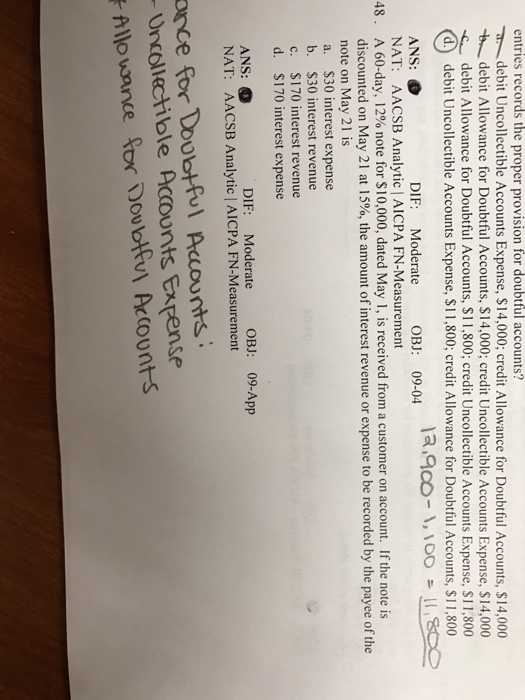

A 60-day, 12% note for $10,000, dated May 1, is received from a customer on account. If the note is discounted on May 21 at 15%, the amount of interest revenue or expense to be recorded by the payee of the note on May 21 is a. $30 interest expense b. $30 interest revenue c. $170 interest revenue d. $170 interest expense ANS: DIF: Moderate OBJ: 09-App NAT: AACSB Analytic | AICPA FN-Measurement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts