Question: A= 7 and B= 8 For the following production function: y = K L a. Show whether the function exhibits constant, increasing or decreasing returns

A= 7 and B= 8

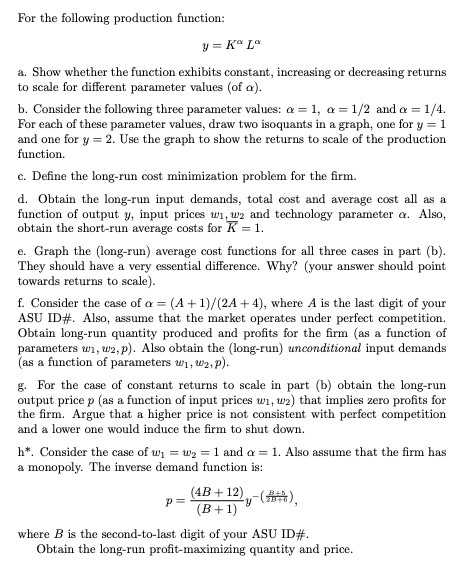

For the following production function: y = K L" a. Show whether the function exhibits constant, increasing or decreasing returns to scale for different parameter values (of o). b. Consider the following three parameter values: a = 1, o = 1/2 and a = 1/4. For each of these parameter values, draw two isoquants in a graph, one for y = 1 and one for y = 2. Use the graph to show the returns to scale of the production function. c. Define the long-run cost minimization problem for the firm. d. Obtain the long-run input demands, total cost and average cost all as a function of output y, input prices wi, w2 and technology parameter a. Also, obtain the short-run average costs for K = 1. e. Graph the (long-run) average cost functions for all three cases in part (b). They should have a very essential difference. Why? (your answer should point towards returns to scale). f. Consider the case of o = (A + 1)/(2A + 4), where A is the last digit of your ASU ID#. Also, assume that the market operates under perfect competition. Obtain long-run quantity produced and profits for the firm (as a function of parameters uh, w2, p). Also obtain the (long-run) unconditional input demands (as a function of parameters w1, w2, p). g. For the case of constant returns to scale in part (b) obtain the long-run output price p (as a function of input prices w1, w2) that implies zero profits for the firm. Argue that a higher price is not consistent with perfect competition and a lower one would induce the firm to shut down. h*. Consider the case of w1 = w2 = 1 and o = 1. Also assume that the firm has a monopoly. The inverse demand function is: P = (4.B + 12) (B + 1) where B is the second-to-last digit of your ASU ID#. Obtain the long-run profit-maximizing quantity and price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts