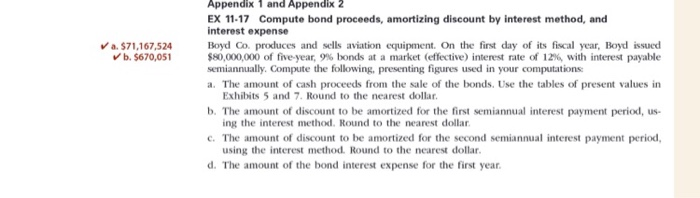

Question: a $71,167,524 b. $670,051 Appendix 1 and Appendix 2 EX 11-17 Compute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces

a $71,167,524 b. $670,051 Appendix 1 and Appendix 2 EX 11-17 Compute bond proceeds, amortizing discount by interest method, and interest expense Boyd Co. produces and sells aviation equipment. On the first day of its fiscal year, Boyd issued $80,000,000 of five year, 9% bonds at a market (effective) interest rate of 12%, with interest payable semiannually. Compute the following presenting figures used in your computations: a. The amount of cash proceeds from the sale of the bonds. Use the tables of present values in Exhibits 5 and 7. Round to the nearest dollar. b. The amount of discount to be amortized for the first semiannual interest payment period, us- ing the interest method. Round to the nearest dollar c. The amount of discount to be amortized for the second semiannual interest payment period, using the interest method. Round to the nearest dollar. d. The amount of the bond interest expense for the first year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts