Question: A 7-year municipal bond yields 4.8%. Your marginal tax rate (including state and federal taxes) is 27%. What interest rate on a 7 year corporate

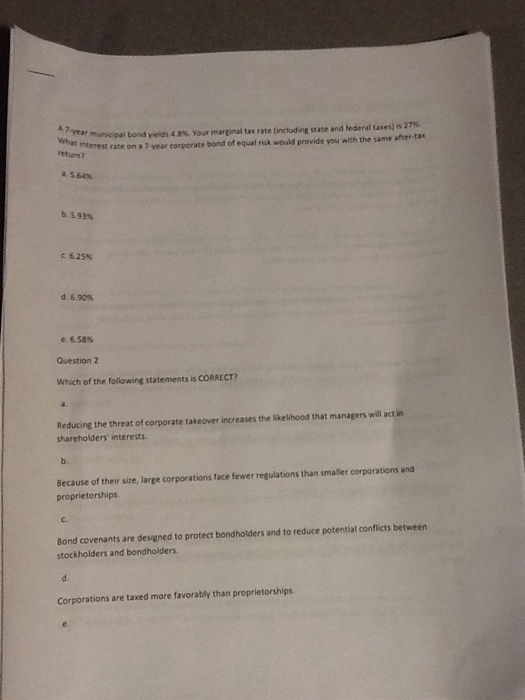

A 7-year municipal bond yields 4.8%. Your marginal tax rate (including state and federal taxes) is 27%. What interest rate on a 7 year corporate bond of equal risk would provide you with the same after-tax return? 5.64% 5.93% 6.25% 6.90% 6.58% Which of the following statements is CORRECT? Reducing the threat of corporate takeover increases the that managers will act in shareholders' interests. Because of their size, large corporations face fewer regulations than smaller corporations and proprietorships Bond covenants are designed to protect bondholders and to reduce potential conflicts between stockholders and bondholders. Corporations are taxed more favorably than proprietorships

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts