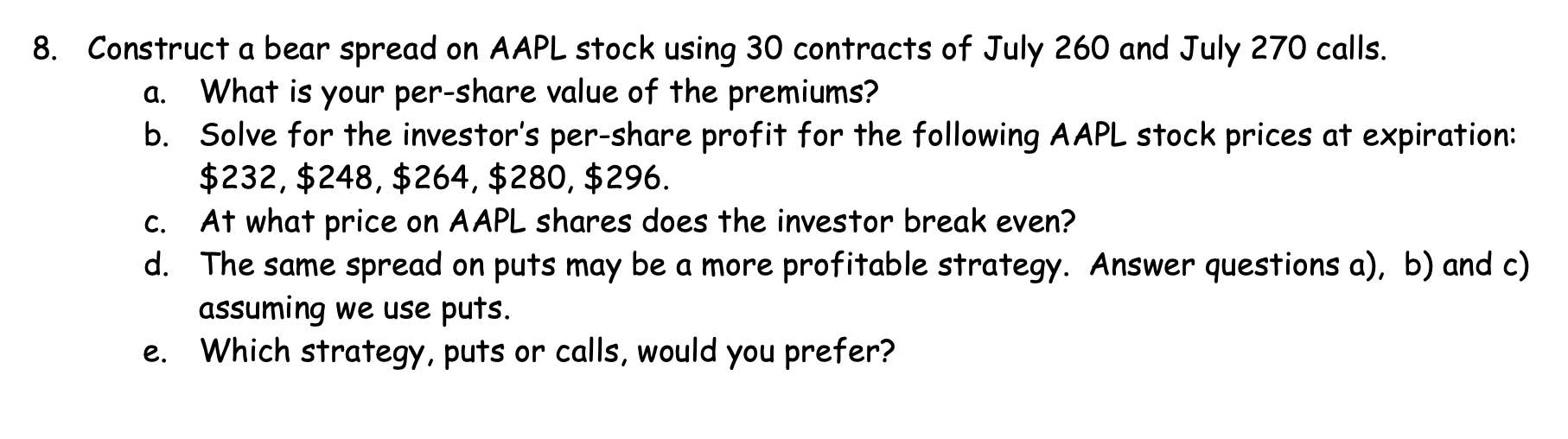

Question: a. 8. Construct a bear spread on AAPL stock using 30 contracts of July 260 and July 270 calls. What is your per-share value of

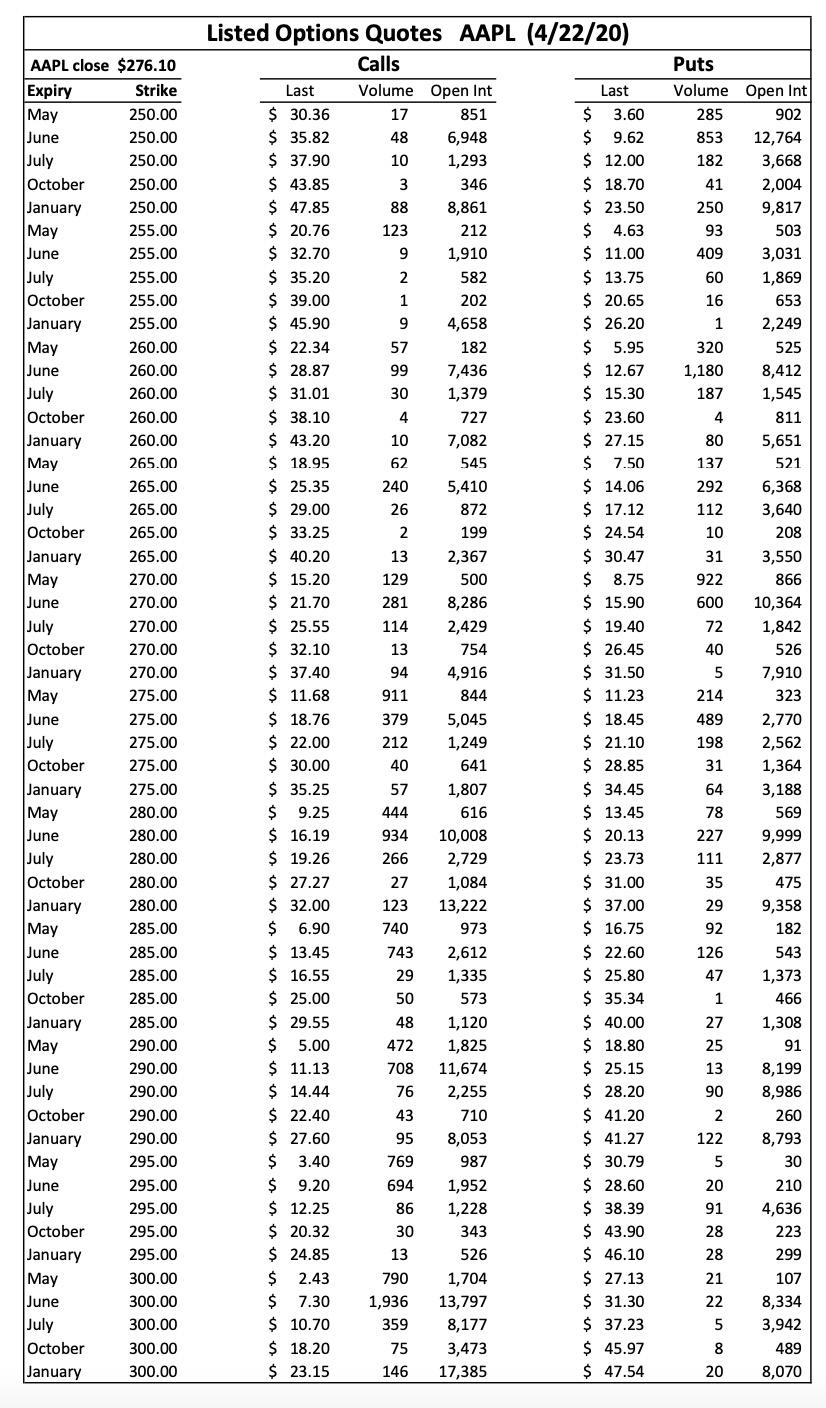

a. 8. Construct a bear spread on AAPL stock using 30 contracts of July 260 and July 270 calls. What is your per-share value of the premiums? b. Solve for the investor's per-share profit for the following AAPL stock prices at expiration: $232, $248, $264, $280, $296. At what price on A APL shares does the investor break even? d. The same spread on puts may be a more profitable strategy. Answer questions a), b) and c) assuming we use puts. e. Which strategy, puts or calls, would you prefer? C. 7,082 872 199 500 8,286 AAPL close $276.10 Expiry Strike May 250.00 June 250.00 July 250.00 October 250.00 January 250.00 May 255.00 June 255.00 July 255.00 October 255.00 January 255.00 |May 260.00 June 260.00 July 260.00 October 260.00 January 260.00 May 265.00 June 265.00 July 265.00 October 265.00 January 265.00 May 270.00 June 270.00 July 270.00 October 270.00 January 270.00 May 275.00 June 275.00 July 275.00 October 275.00 January 275.00 May 280.00 June 280.00 July 280.00 October 280.00 January 280.00 |May 285.00 June 285.00 July 285.00 October 285.00 January 285.00 May 290.00 June 290.00 July 290.00 October 290.00 January 290.00 May 295.00 June 295.00 July 295.00 October 295.00 January 295.00 May 300.00 June 300.00 July 300.00 October 300.00 January 300.00 Listed Options Quotes AAPL (4/22/20) Calls Last Volume Open Int Last $ 30.36 17 851 $ 3.60 $ 35.82 48 6,948 $ 9.62 $ 37.90 10 1,293 $ 12.00 $ 43.85 3 346 $ 18.70 $ 47.85 88 8,861 $ 23.50 $ 20.76 123 212 $ 4.63 $ 32.70 9 1,910 $ 11.00 $ 35.20 2 582 $ 13.75 $ 39.00 1 202 $ 20.65 $ 45.90 9 4,658 $ 26.20 $ 22.34 57 182 $ 5.95 $ 28.87 99 7,436 $ 12.67 $ 31.01 30 1,379 $ 15.30 $ 38.10 4 727 $ 23.60 $ 43.20 10 $ 27.15 $18.95 62 545 $ 7.50 $ 25.35 240 5,410 $ 14.06 $ 29.00 26 $ 17.12 $ 33.25 2 $ 24.54 $ 40.20 13 2,367 $ 30.47 $ 15.20 129 $ 8.75 $ 21.70 281 $ 15.90 $ 25.55 114 2,429 $ 19.40 $ 32.10 13 754 $26.45 $ 37.40 94 4,916 $ 31.50 $ 11.68 911 844 $ 11.23 $18.76 379 5,045 $ 18.45 $ 22.00 212 1,249 $ 21.10 $ 30.00 40 641 $ 28.85 $ 35.25 57 1,807 $ 34.45 $ 9.25 444 616 $ 13.45 $ 16.19 934 10,008 $ 20.13 $ 19.26 266 $ 23.73 $ 27.27 27 1,084 $ 31.00 $ 32.00 123 13,222 $ 37.00 $ 6.90 740 973 $ 16.75 $ 13.45 743 2,612 $ 22.60 $ 16.55 29 1,335 $ 25.80 $ 25.00 50 573 $ 35.34 $ 29.55 48 1,120 $ 40.00 $ 5.00 472 1,825 $ 18.80 $ 11.13 708 11,674 $ 25.15 $ 14.44 76 2,255 $ 28.20 $ 22.40 43 710 $ 41.20 $ 27.60 95 8,053 $ 41.27 $ 3.40 769 $ 30.79 $ 9.20 694 1,952 $ 28.60 $ 12.25 86 1,228 $ 38.39 $ 20.32 30 343 $ 43.90 $ 24.85 13 526 $ 46.10 $ 2.43 790 1,704 $ 27.13 $ 7.30 1,936 13,797 $ 31.30 $ 10.70 359 $ 37.23 $ 18.20 75 3,473 $ 45.97 $ 23.15 146 17,385 $ 47.54 Puts Volume Open Int 285 902 853 12,764 182 3,668 41 2,004 250 9,817 93 503 409 3,031 60 1,869 16 653 1 2,249 320 525 1,180 8,412 187 1,545 4 811 80 5,651 137 292 6,368 112 3,640 10 208 31 3,550 922 866 600 10,364 72 1,842 40 526 5 7,910 214 323 489 2,770 198 2,562 31 1,364 64 3,188 78 569 227 9,999 111 2,877 35 475 29 9,358 92 182 126 543 47 1,373 1 466 27 1,308 25 91 13 8,199 90 8,986 2 260 122 8,793 5 30 20 210 91 4,636 28 223 28 299 21 107 22 8,334 5 3,942 8 489 20 8,070 2,729 987 8,177 a. 8. Construct a bear spread on AAPL stock using 30 contracts of July 260 and July 270 calls. What is your per-share value of the premiums? b. Solve for the investor's per-share profit for the following AAPL stock prices at expiration: $232, $248, $264, $280, $296. At what price on A APL shares does the investor break even? d. The same spread on puts may be a more profitable strategy. Answer questions a), b) and c) assuming we use puts. e. Which strategy, puts or calls, would you prefer? C. 7,082 872 199 500 8,286 AAPL close $276.10 Expiry Strike May 250.00 June 250.00 July 250.00 October 250.00 January 250.00 May 255.00 June 255.00 July 255.00 October 255.00 January 255.00 |May 260.00 June 260.00 July 260.00 October 260.00 January 260.00 May 265.00 June 265.00 July 265.00 October 265.00 January 265.00 May 270.00 June 270.00 July 270.00 October 270.00 January 270.00 May 275.00 June 275.00 July 275.00 October 275.00 January 275.00 May 280.00 June 280.00 July 280.00 October 280.00 January 280.00 |May 285.00 June 285.00 July 285.00 October 285.00 January 285.00 May 290.00 June 290.00 July 290.00 October 290.00 January 290.00 May 295.00 June 295.00 July 295.00 October 295.00 January 295.00 May 300.00 June 300.00 July 300.00 October 300.00 January 300.00 Listed Options Quotes AAPL (4/22/20) Calls Last Volume Open Int Last $ 30.36 17 851 $ 3.60 $ 35.82 48 6,948 $ 9.62 $ 37.90 10 1,293 $ 12.00 $ 43.85 3 346 $ 18.70 $ 47.85 88 8,861 $ 23.50 $ 20.76 123 212 $ 4.63 $ 32.70 9 1,910 $ 11.00 $ 35.20 2 582 $ 13.75 $ 39.00 1 202 $ 20.65 $ 45.90 9 4,658 $ 26.20 $ 22.34 57 182 $ 5.95 $ 28.87 99 7,436 $ 12.67 $ 31.01 30 1,379 $ 15.30 $ 38.10 4 727 $ 23.60 $ 43.20 10 $ 27.15 $18.95 62 545 $ 7.50 $ 25.35 240 5,410 $ 14.06 $ 29.00 26 $ 17.12 $ 33.25 2 $ 24.54 $ 40.20 13 2,367 $ 30.47 $ 15.20 129 $ 8.75 $ 21.70 281 $ 15.90 $ 25.55 114 2,429 $ 19.40 $ 32.10 13 754 $26.45 $ 37.40 94 4,916 $ 31.50 $ 11.68 911 844 $ 11.23 $18.76 379 5,045 $ 18.45 $ 22.00 212 1,249 $ 21.10 $ 30.00 40 641 $ 28.85 $ 35.25 57 1,807 $ 34.45 $ 9.25 444 616 $ 13.45 $ 16.19 934 10,008 $ 20.13 $ 19.26 266 $ 23.73 $ 27.27 27 1,084 $ 31.00 $ 32.00 123 13,222 $ 37.00 $ 6.90 740 973 $ 16.75 $ 13.45 743 2,612 $ 22.60 $ 16.55 29 1,335 $ 25.80 $ 25.00 50 573 $ 35.34 $ 29.55 48 1,120 $ 40.00 $ 5.00 472 1,825 $ 18.80 $ 11.13 708 11,674 $ 25.15 $ 14.44 76 2,255 $ 28.20 $ 22.40 43 710 $ 41.20 $ 27.60 95 8,053 $ 41.27 $ 3.40 769 $ 30.79 $ 9.20 694 1,952 $ 28.60 $ 12.25 86 1,228 $ 38.39 $ 20.32 30 343 $ 43.90 $ 24.85 13 526 $ 46.10 $ 2.43 790 1,704 $ 27.13 $ 7.30 1,936 13,797 $ 31.30 $ 10.70 359 $ 37.23 $ 18.20 75 3,473 $ 45.97 $ 23.15 146 17,385 $ 47.54 Puts Volume Open Int 285 902 853 12,764 182 3,668 41 2,004 250 9,817 93 503 409 3,031 60 1,869 16 653 1 2,249 320 525 1,180 8,412 187 1,545 4 811 80 5,651 137 292 6,368 112 3,640 10 208 31 3,550 922 866 600 10,364 72 1,842 40 526 5 7,910 214 323 489 2,770 198 2,562 31 1,364 64 3,188 78 569 227 9,999 111 2,877 35 475 29 9,358 92 182 126 543 47 1,373 1 466 27 1,308 25 91 13 8,199 90 8,986 2 260 122 8,793 5 30 20 210 91 4,636 28 223 28 299 21 107 22 8,334 5 3,942 8 489 20 8,070 2,729 987 8,177

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts