Question: (a) (8 marks) Calculate the operating leverage (OL) and financial leverage (FL) for a firm with sales of 1,000 units with a selling price of

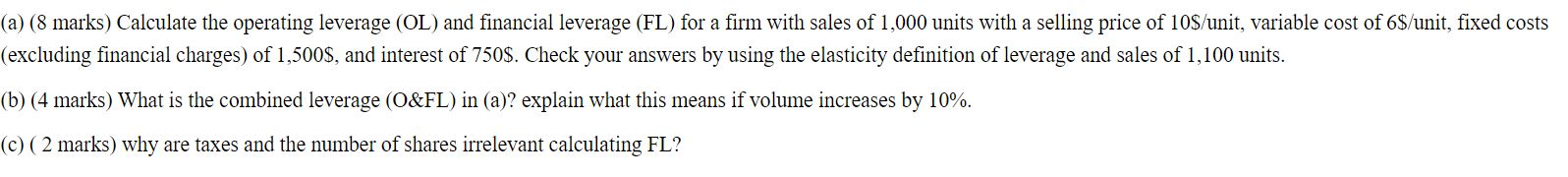

(a) (8 marks) Calculate the operating leverage (OL) and financial leverage (FL) for a firm with sales of 1,000 units with a selling price of 10$/unit, variable cost of 6$/unit, fixed costs (excluding financial charges) of 1,500$, and interest of 750$. Check your answers by using the elasticity definition of leverage and sales of 1,100 units. (b) (4 marks) What is the combined leverage (O&FL) in (a)? explain what this means if volume increases by 10%. (c) (2 marks) why are taxes and the number of shares irrelevant calculating FL? (a) (8 marks) Calculate the operating leverage (OL) and financial leverage (FL) for a firm with sales of 1,000 units with a selling price of 10$/unit, variable cost of 6$/unit, fixed costs (excluding financial charges) of 1,500$, and interest of 750$. Check your answers by using the elasticity definition of leverage and sales of 1,100 units. (b) (4 marks) What is the combined leverage (O&FL) in (a)? explain what this means if volume increases by 10%. (c) (2 marks) why are taxes and the number of shares irrelevant calculating FL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts