Question: a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 10.5 percent. Interest payments are $52.50

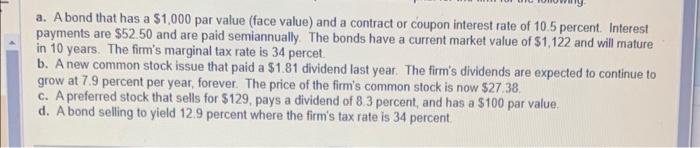

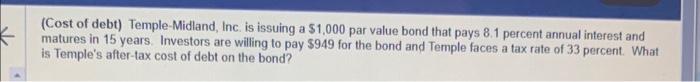

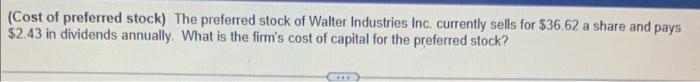

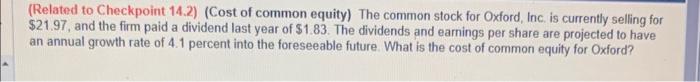

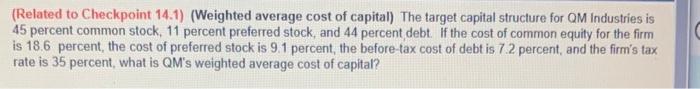

a. A bond that has a $1,000 par value (face value) and a contract or coupon interest rate of 10.5 percent. Interest payments are $52.50 and are paid semiannually. The bonds have a current market value of $1,122 and will mature in 10 years. The firm's marginal tax rate is 34 percet. b. A new common stock issue that paid a $1.81 dividend last year. The firm's dividends are expected to continue to grow at 7.9 percent per year, forever. The price of the firm's common stock is now $27.38. c. A preferred stock that sells for $129, pays a dividend of 8.3 percent, and has a $100 par value. d. A bond selling to yield 12.9 percent where the firm's tax rate is 34 percent. (Cost of debt) Temple-Midland, Inc. is issuing a $1,000 par value bond that pays 8.1 percent annual interest and matures in 15 years. Investors are willing to pay $949 for the bond and Temple faces a tax rate of 33 percent. What is Temple's after-tax cost of debt on the bond? (Cost of preferred stock) The preferred stock of Walter Industries Inc. currently sells for $36.62 a share and pays $2.43 in dividends annually. What is the firm's cost of capital for the preferred stock? (Related to Checkpoint 14.2) (Cost of common equity) The common stock for Oxford, Inc. is currently selling for $21.97, and the firm paid a dividend last year of $1.83. The dividends and earnings per share are projected to have an annual growth rate of 4.1 percent into the foreseeable future. What is the cost of common equity for Oxford? (Related to Checkpoint 14.1) (Weighted average cost of capital) The target capital structure for QM Industries is 45 percent common stock, 11 percent preferred stock, and 44 percent debt. If the cost of common equity for the firm is 18.6 percent, the cost of preferred stock is 9.1 percent, the before-tax cost of debt is 7.2 percent, and the firm's tax rate is 35 percent, what is QM's weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts