Question: a A building contractor is preparing a bid on a new construction project. Two other contractors will be submitting bids for the same project. Based

a

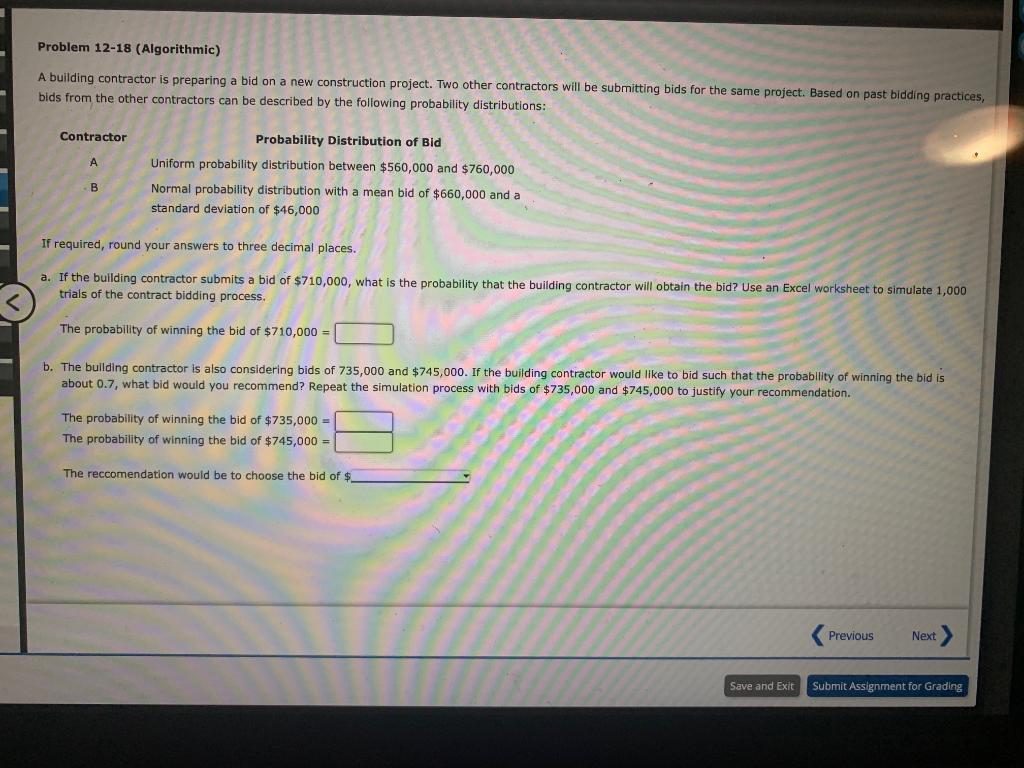

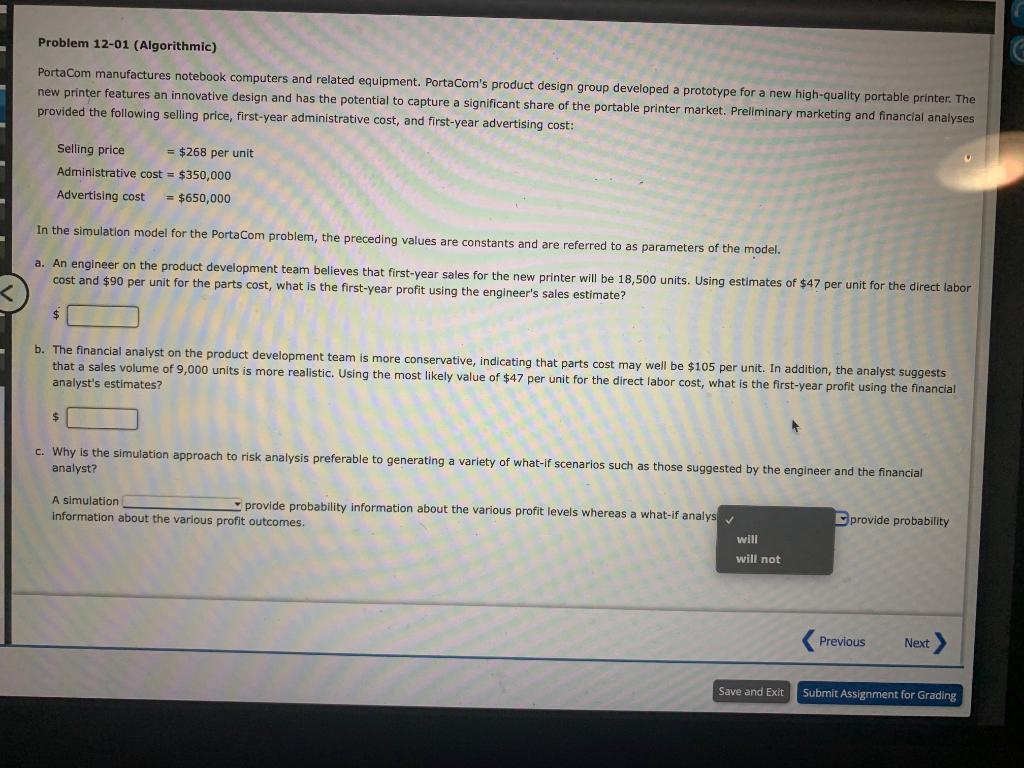

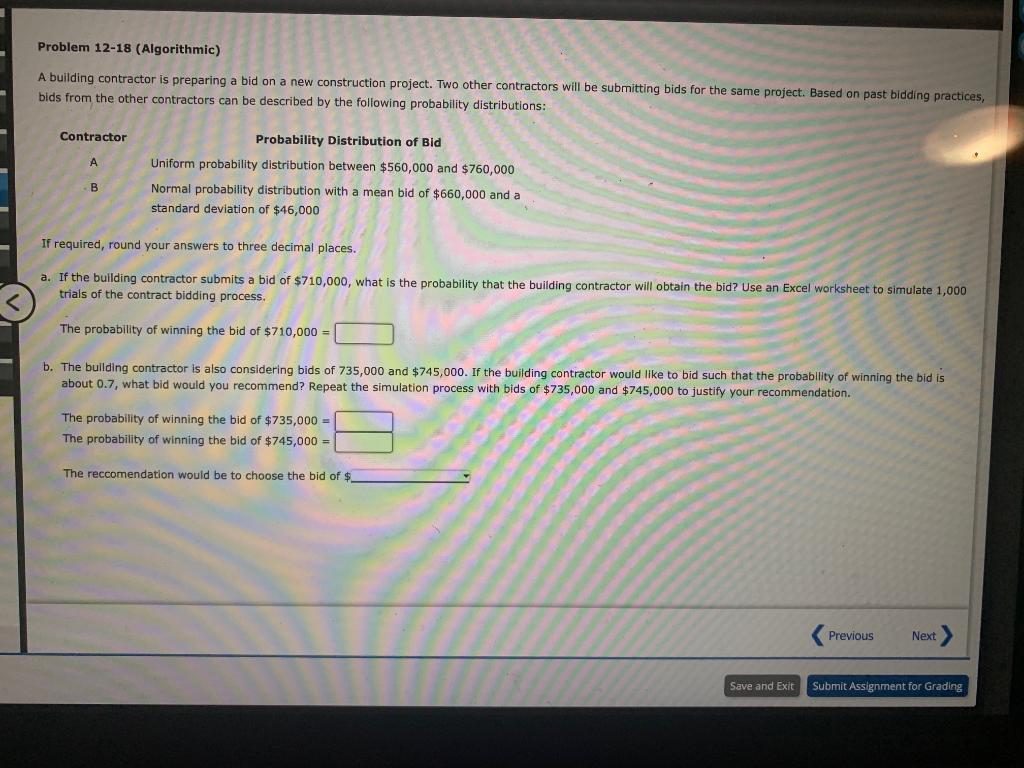

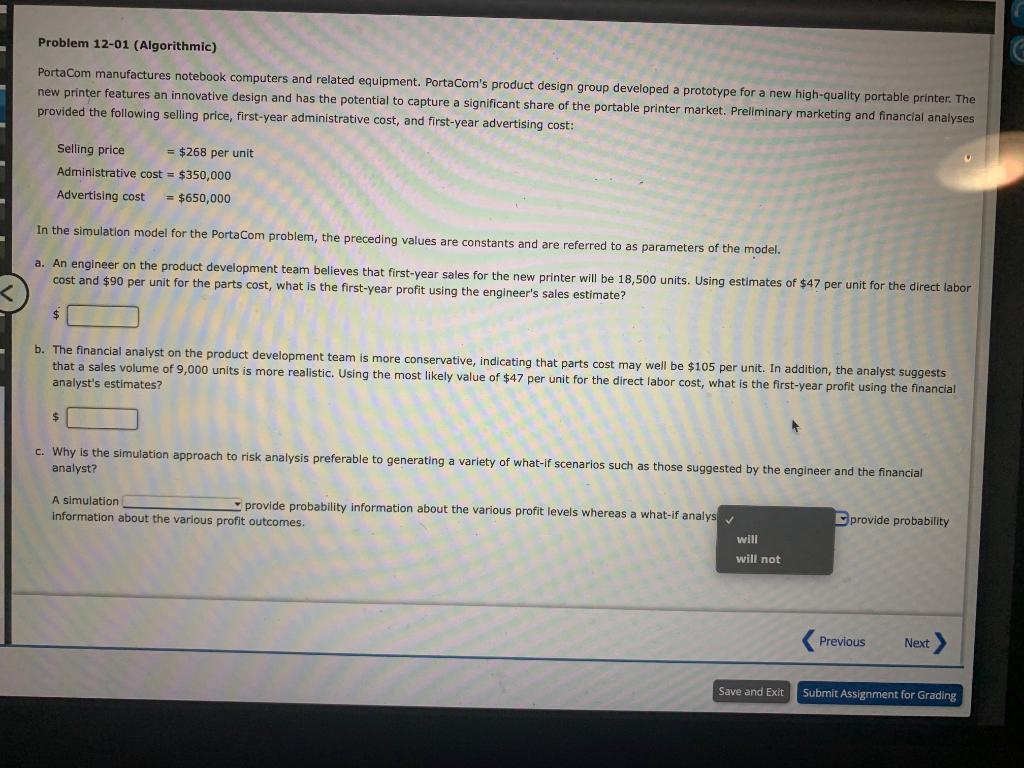

A building contractor is preparing a bid on a new construction project. Two other contractors will be submitting bids for the same project. Based on past bidding practices bids from the other contractors can be described by the following probability distributions: If required, round your answers to three decimal places. a. If the building contractor submits a bid of $710,000, what is the probability that the building contractor will obtain the bid? Use an Excel worksheet to simulate 1,000 trials of the contract bidding process. The probability of winning the bid of $710,000= b. The bullding contractor is also considering bids of 735,000 and $745,000. If the building contractor would like to bid such that the probability of winning the bid is about 0.7, what bid would you recommend? Repeat the simulation process with bids of $735,000 and $745,000 to justify your recommendation. The probability of winning the bid of $735,000= The probability of winning the bid of $745,000= The reccomendation would be to choose the bid of : PortaCom manufactures notebook computers and related equipment. PortaCom's product design group developed a prototype for a new high-quality portable printer. The new printer features an innovative design and has the potential to capture a significant share of the portable printer market. Preliminary marketing and financial analy provided the following selling price, first-year administrative cost, and first-year advertising cost: Selling price =$268 per unit Administrative cost =$350,000 Advertising cost =$650,000 In the simulation model for the PortaCom problem, the preceding values are constants and are referred to as parameters of the model. a. An engineer on the product development team believes that first-year sales for the new printer will be 18,500 units. Using estimates of $47 per unit for the direct labor cost and $90 per unit for the parts cost, what is the first-year profit using the engineer's sales estimate? $ b. The financial analyst on the product development team is more conservative, indicating that parts cost may well be $105 per unit. In addition, the analyst suggests that a sales volume of 9,000 units is more realistic. Using the most likely value of $47 per unit for the direct labor cost, what is the first-year profit using the financial analyst's estimates? $ c. Why is the simulation approach to risk analysis preferable to generating a variety of what-if scenarios such as those suggested by the engineer and the financial analyst? A simulation provide probability information about the various profit levels whereas a what-if analy: Information about the various profit outcomes. Eprovide probability