Question: A. A building is insured on a Basic Perils Policy in the amount of $150,000, the deductible is $500. What would be paid in the

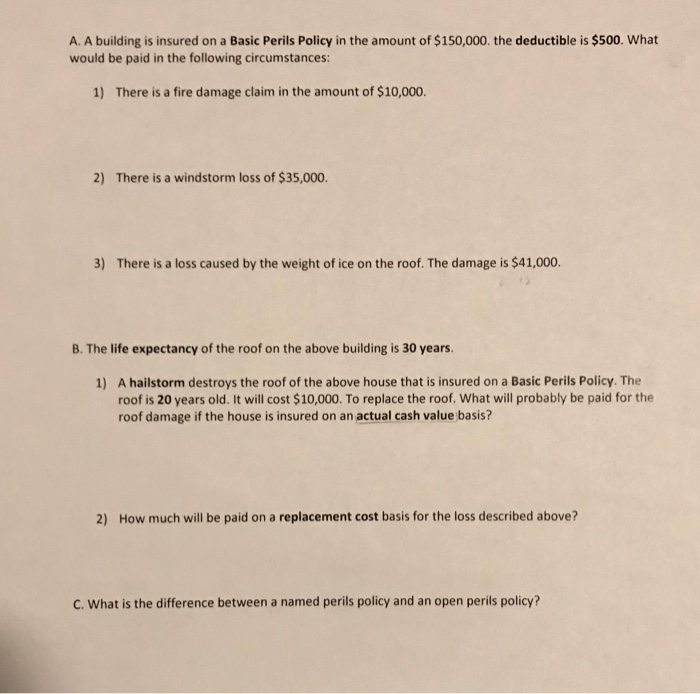

A. A building is insured on a Basic Perils Policy in the amount of $150,000, the deductible is $500. What would be paid in the following circumstances: 1) There is a fire damage claim in the amount of $10,000 2) There is a windstorm loss of $35,000. 3) There is a loss caused by the weight of ice on the roof. The damage is $41,000. B. The life expectancy of the roof on the above building is 30 years. 1) A hailstorm destroys the roof of the above house that is insured on a Basic Perils Policy. The roof is 20 years old. It will cost $10,000. To replace the roof. What will probably be paid for the roof damage if the house is insured on an actual cash value basis? 2) How much will be paid on a replacement cost basis for the loss described above? C. What is the difference between a named perils policy and an open perils policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts