Question: a. a. c. 1. Which has the most downside potential? a. Selling a put option b. Buying a put option C. Buying a call option

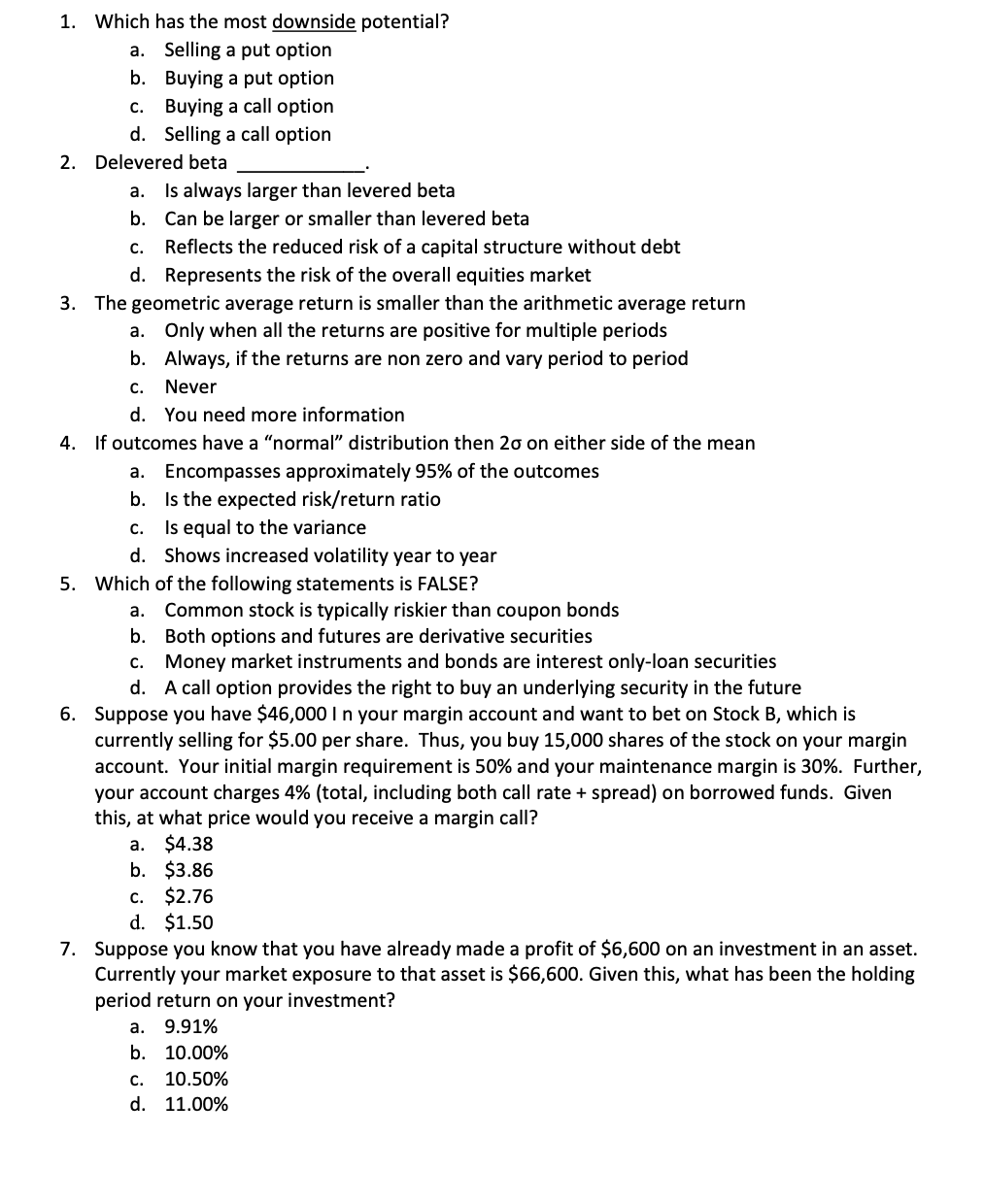

a. a. c. 1. Which has the most downside potential? a. Selling a put option b. Buying a put option C. Buying a call option d. Selling a call option 2. Delevered beta Is always larger than levered beta b. Can be larger or smaller than levered beta c. Reflects the reduced risk of a capital structure without debt d. Represents the risk of the overall equities market 3. The geometric average return is smaller than the arithmetic average return Only when all the returns are positive for multiple periods b. Always, if the returns are non zero and vary period to period c. Never d. You need more information 4. If outcomes have a "normal" distribution then 20 on either side of the mean a. Encompasses approximately 95% of the outcomes b. Is the expected risk/return ratio Is equal to the variance d. Shows increased volatility year to year 5. Which of the following statements is FALSE? Common stock is typically riskier than coupon bonds b. Both options and futures are derivative securities C. Money market instruments and bonds are interest only-loan securities d. A call option provides the right to buy an underlying security in the future 6. Suppose you have $46,000 1 n your margin account and want to bet on Stock B, which is currently selling for $5.00 per share. Thus, you buy 15,000 shares of the stock on your margin account. Your initial margin requirement is 50% and your maintenance margin is 30%. Further, your account charges 4% (total, including both call rate + spread) on borrowed funds. Given this, at what price would you receive a margin call? a. $4.38 b. $3.86 c. $2.76 d. $1.50 7. Suppose you know that you have already made a profit of $6,600 on an investment in an asset. Currently your market exposure to that asset is $66,600. Given this, what has been the holding period return on your investment? a. 9.91% b. 10.00% c. 10.50% d. 11.00% a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts