Question: a A E L 21 01 el et Heading 1 No Spac... Heading 2 Subtle Em.. 1 Normal Title Subtitle Paragraph Styles (1) Describe the

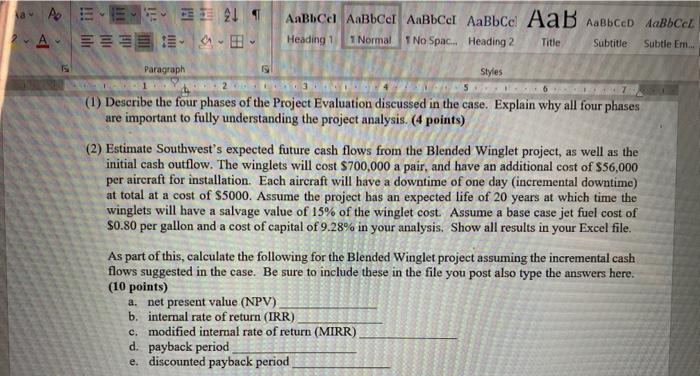

a A E L 21 01 el et Heading 1 No Spac... Heading 2 Subtle Em.. 1 Normal Title Subtitle Paragraph Styles (1) Describe the four phases of the Project Evaluation discussed in the case. Explain why all four phases are important to fully understanding the project analysis. (4 points) (2) Estimate Southwest's expected future cash flows from the Blended Winglet project, as well as the initial cash outflow. The winglets will cost $700,000 a pair, and have an additional cost of $56,000 per aircraft for installation. Each aircraft will have a downtime of one day (incremental downtime) at total at a cost of $5000. Assume the project has an expected life of 20 years at which time the winglets will have a salvage value of 15% of the winglet cost. Assume a base case jet fuel cost of $0.80 per gallon and a cost of capital of 9.28% in your analysis. Show all results in your Excel file. As part of this, calculate the following for the Blended Winglet project assuming the incremental cash flows suggested in the case. Be sure to include these in the file you post also type the answers here. (10 points) a. net present value (NPV) b. internal rate of return (IRR) c.modified internal rate of return (MIRR) d. payback period e. discounted payback period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts