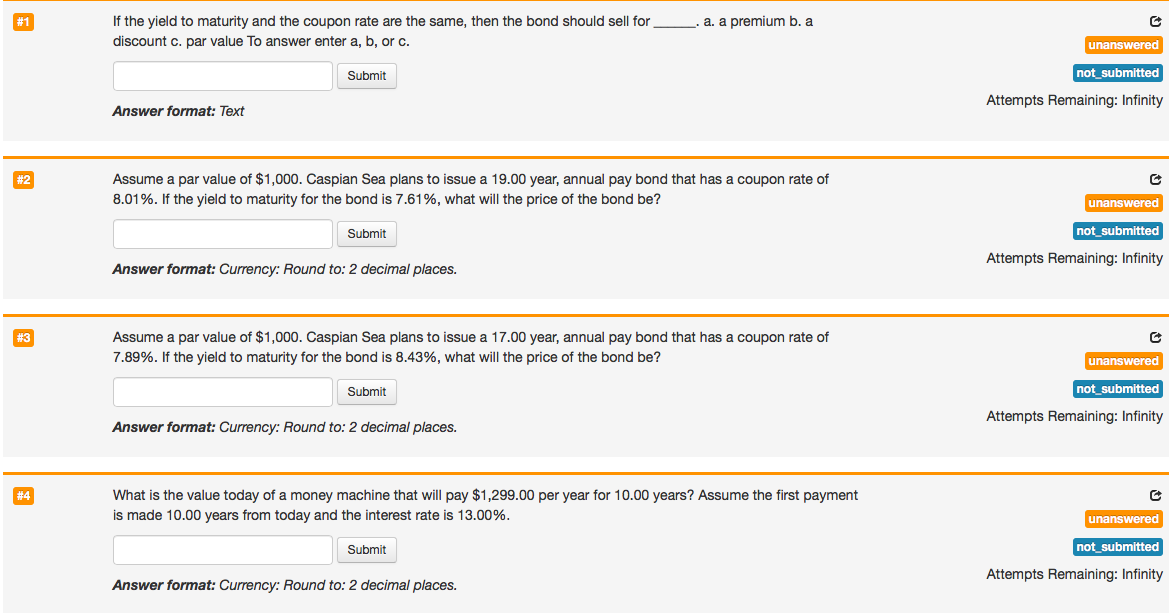

Question: a. a premium b. a If the yield to maturity and the coupon rate are the same, then the bond should sell for discount c.

a. a premium b. a If the yield to maturity and the coupon rate are the same, then the bond should sell for discount c. par value to answer enter a, b, or c. unanswered Submit not submitted Attempts Remaining: Infinity Answer format: Text #2 Assume a par value of $1,000. Caspian Sea plans to issue a 19.00 year, annual pay bond that has a coupon rate of 8.01%. If the yield to maturity for the bond is 7.61%, what will the price of the bond be? unanswered Submit not_submitted Attempts Remaining: Infinity Answer format: Currency: Round to: 2 decimal places. Assume a par value of $1,000. Caspian Sea plans to issue a 17.00 year, annual pay bond that has a coupon rate of 7.89%. If the yield to maturity for the bond is 8.43%, what will the price of the bond be? unanswered Submit not_submitted Attempts Remaining: Infinity Answer format: Currency: Round to: 2 decimal places. #4 What is the value today of a money machine that will pay $1,299.00 per year for 10.00 years? Assume the first payment is made 10.00 years from today and the interest rate is 13.00%. unanswered Submit not_submitted Attempts Remaining: Infinity Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts