Question: a a. Question 4 (15 Marks) Given that there are two financial securities: Security A and Security B. Security A is a risk-free investment with

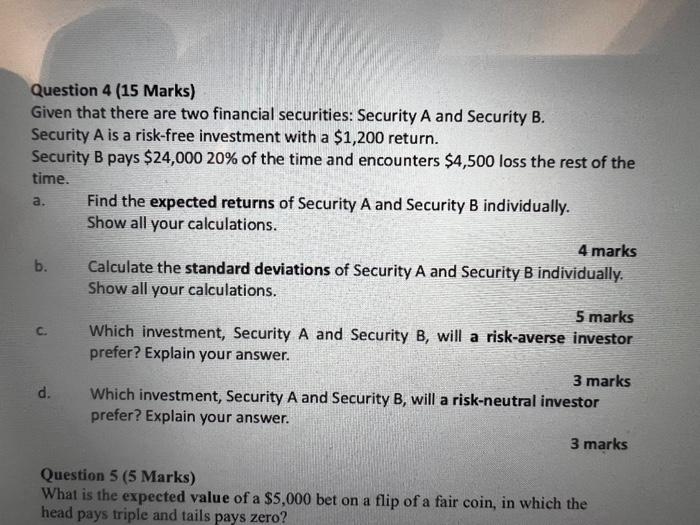

a a. Question 4 (15 Marks) Given that there are two financial securities: Security A and Security B. Security A is a risk-free investment with a $1,200 return. Security B pays $24,000 20% of the time and encounters $4,500 loss the rest of the time. Find the expected returns of Security A and Security B individually. Show all your calculations. 4 marks b. Calculate the standard deviations of Security A and Security B individually. Show all your calculations. 5 marks Which investment, Security A and Security B, will a risk-averse investor prefer? Explain your answer. 3 marks d. Which investment, Security A and Security B, will a risk-neutral investor prefer? Explain your answer. 3 marks . c Question 5 (5 Marks) What is the expected value of a $5,000 bet on a flip of a fair coin, in which the head pays triple and tails pays zero

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts