Question: a) A rationale for why or why not the incremental approach to calculate the NPV is appropriate for this kind of decision. b) The NPV

a) A rationale for why or why not the incremental approach to calculate the NPV is appropriate for this kind of decision.

b) The NPV and internal rate of return for the proposed labour intensive project (include calculations).

c) The NPV of the proposed capital intensive project (include calculations).

d) Clearly indicate of which project you would recommend and why you are recommending this one over the other.

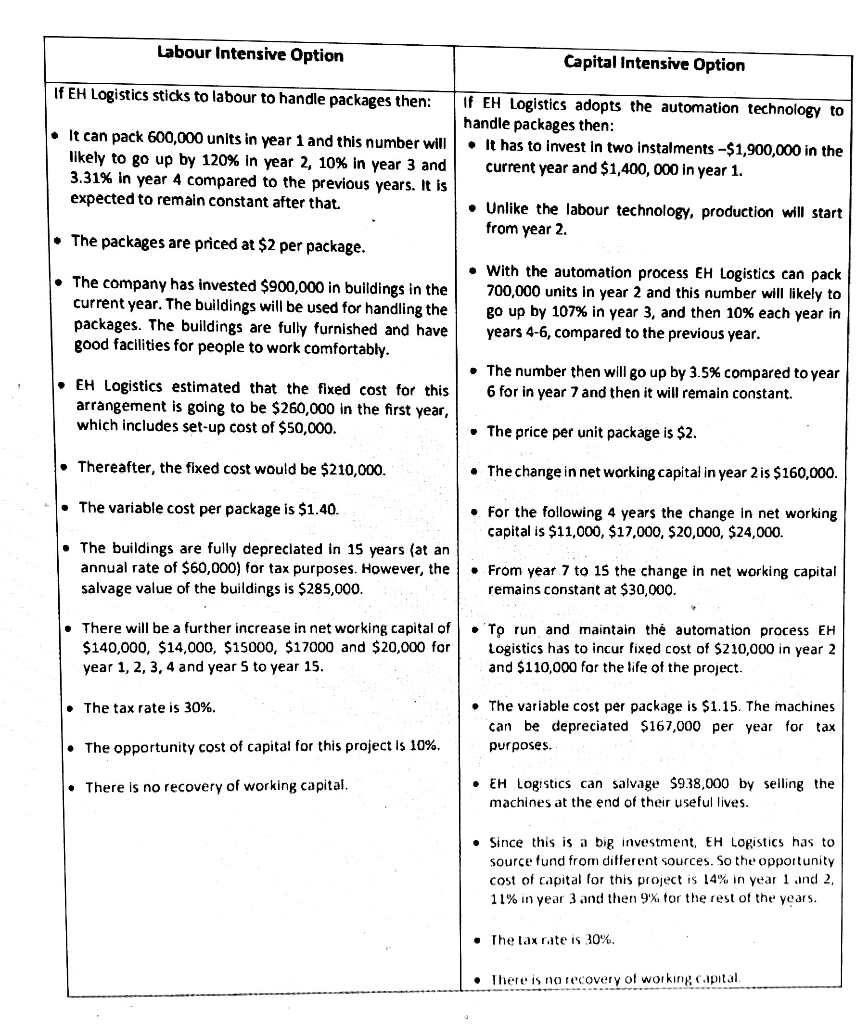

Labour Intensive Option Capital Intensive Option If EH Logistics sticks to labour to handle packages then: It can pack 600,000 units in year 1 and this number will likely to go up by 120% in year 2, 10% in year 3 and 3.31% in year 4 compared to the previous years. It is expected to remain constant after that. If EH Logistics adopts the automation technology to handle packages then: . It has to invest in two instalments -$1,900,000 in the current year and $1,400,000 in year 1. Unlike the labour technology, production will start from year 2. The packages are priced at $2 per package. The company has invested $900,000 in buildings in the Current year. The buildings will be used for handling the packages. The buildings are fully furnished and have good facilities for people to work comfortably. With the automation process EH Logistics can pack 700,000 units in year 2 and this number will likely to go up by 107% in year 3, and then 10% each year in years 4-6, compared to the previous year. The number then will go up by 3.5% compared to year 6 for in year 7 and then it will remain constant. EH Logistics estimated that the fixed cost for this arrangement is going to be $260,000 in the first year, which includes set-up cost of $50,000. . The price per unit package is $2. Thereafter, the fixed cost would be $210,000. The change in net working capital in year 2 is $160,000. The variable cost per package is $1.40. . For the following 4 years the change in net working capital is $11,000, $17,000, $20,000, $24,000. The buildings are fully deprecated in 15 years (at an annual rate of $60,000) for tax purposes. However, the salvage value of the buildings is $285,000. . From year 7 to 15 the change in net working capital remains constant at $30,000. There will be a further increase in net working capital of $140,000, $14,000, $15000, $17000 and $20,000 for year 1, 2, 3, 4 and year 5 to year 15. To run and maintain the automation process EH Logistics has to incur fixed cost of $210,000 in year 2 and $110,000 for the life of the project. The tax rate is 30%. The variable cost per package is $1.15. The machines can be depreciated $167,000 per year for tax purposes. The opportunity cost of capital for this project is 10%. There is no recovery of working capital. EH Logistics can salvage $938,000 by selling the machines at the end of their useful lives. Since this is a big investment, EH Logistics has to source fund from different sources. So the opportunity cost of capital for this project is 14% in year 1 and 2 11% in year 3 and then 9X for the rest of the years. The tax rate is 30%. There is no recovery of working capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts