Question: a A simple example is a bank deposit. Let's say you deposit $1,000 in a bank that pays a 2% annual interest rate. After 1

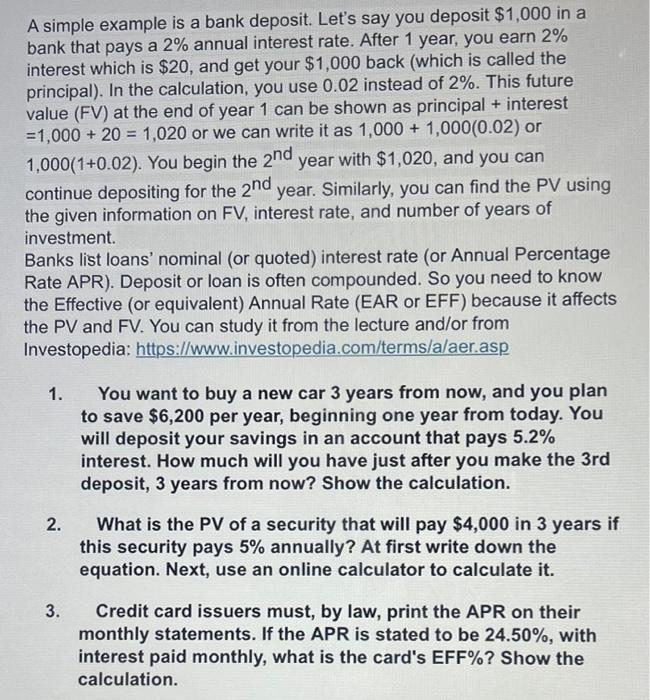

a A simple example is a bank deposit. Let's say you deposit $1,000 in a bank that pays a 2% annual interest rate. After 1 year, you earn 2% interest which is $20, and get your $1,000 back (which is called the principal). In the calculation, you use 0.02 instead of 2%. This future value (FV) at the end of year 1 can be shown as principal + interest =1,000 + 20 = 1,020 or we can write it as 1,000 + 1,000(0.02) or 1,000(1+0.02). You begin the 2nd year with $1,020, and you can continue depositing for the 2nd year. Similarly, you can find the PV using the given information on FV, interest rate, and number of years of investment Banks list loans' nominal (or quoted) interest rate (or Annual Percentage Rate APR). Deposit or loan is often compounded. So you need to know the Effective (or equivalent) Annual Rate (EAR or EFF) because it affects the PV and FV. You can study it from the lecture and/or from Investopedia: https://www.investopedia.com/terms/a/aer.asp 1. You want to buy a new car 3 years from now, and you plan to save $6,200 per year, beginning one year from today. You will deposit your savings in an account that pays 5.2% interest. How much will you have just after you make the 3rd deposit, 3 years from now? Show the calculation. 3 2. What is the PV of a security that will pay $4,000 in 3 years if this security pays 5% annually? At first write down the equation. Next, use an online calculator to calculate it. 3. Credit card issuers must, by law, print the APR on their monthly statements. If the APR is stated to be 24.50%, with interest paid monthly, what is the card's EFF%? Show the calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts